Transformation of the economy was the keystone of Budget 2016.

But many local businesses are not taking steps to change, the latest National Business Survey released by the Singapore Business Federation (SBF) yesterday showed.

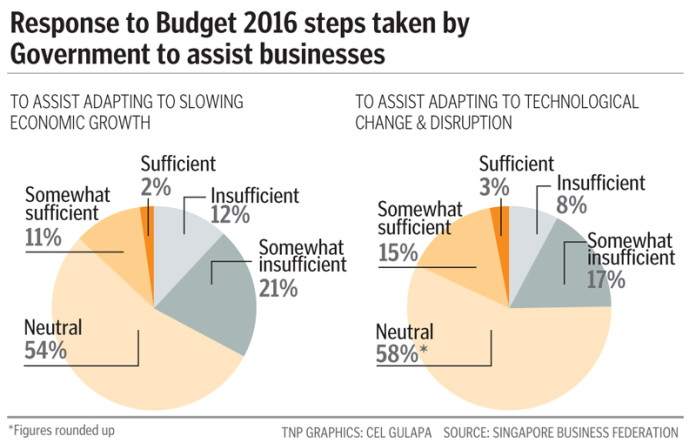

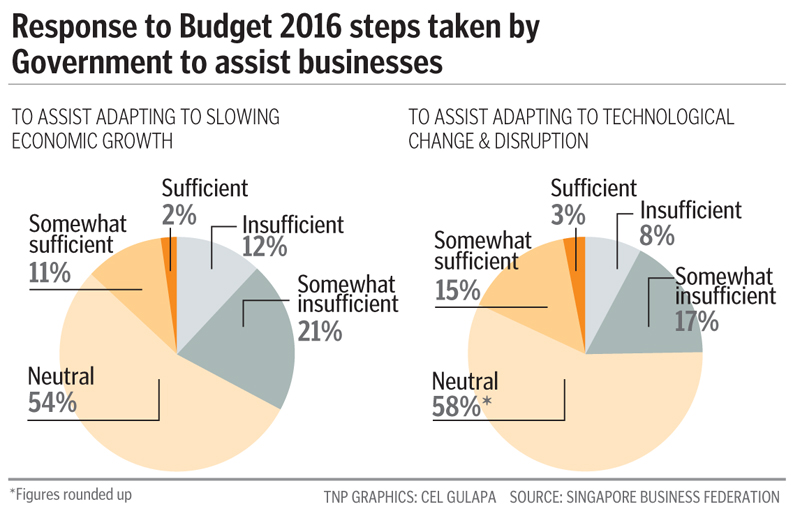

About six in 10 of small- and medium-sized enterprises (SMEs) surveyed have yet to make significant adjustments to adapt to the slowing economic growth and technological change and disruption.

The study, which drew more than 1,100 responses from companies across all major industries, also noted that business sentiment is gloomy.

Nearly two-thirds of businesses say that the economic climate in Singapore has worsened this year, and nearly half of the businesses expect the situation to deteriorate next year.

At the Budget in March, Finance Minister Heng Swee Keat announced that a $4.5 billion Industry Transformation Programme would be rolled out to help firms and industries create new value and drive growth.

One initiative aimed at transforming firms was a new automation support package, worth more than $400 million over the next three years.

Despite the new measures, only about 60 per cent of businesses agreed that they have to transform to adapt to slowing growth and technological change.

Only 28 per cent of businesses expressed satisfaction with the current policies.

This is lower among SMEs – 27 per cent was satisfied, compared to 39 per cent among large companies.

Lack of resources in terms of knowledge, finances and manpower are some of the challenges that local firms face when it comes to transforming their businesses, said Associate Professor Boh Wai Fong from the Nanyang Business School.

Prof Boh, who lectures in Nanyang Technological University, is currently conducting a training and research programme for local SMEs and start-ups on innovation, capabilities and decision-making preferences.

“As local companies try to innovate, they often face challenges in working through technical and feasibility difficulties.

“Environmental unpredictability is also a challenge.

“This includes changes in customers’ tastes, changes in markets and regulations,” added Prof Boh.

TRANSFORM

Mr Ho Meng Kit, CEO of SBF, urged the Government to consider measures that will help businesses overcome the near-term economic headwinds in the upcoming Budget 2017, even as it considers the longer-term strategies for the Singapore economy.

He said: “Having said so, Singapore companies can, and must, transform to find new ways of doing things and offer innovative new products and services.

“At the same time, we encourage our companies to expand to overseas markets.

“The current technological disruption that we are witnessing has lowered the barriers for companies to do all these.”

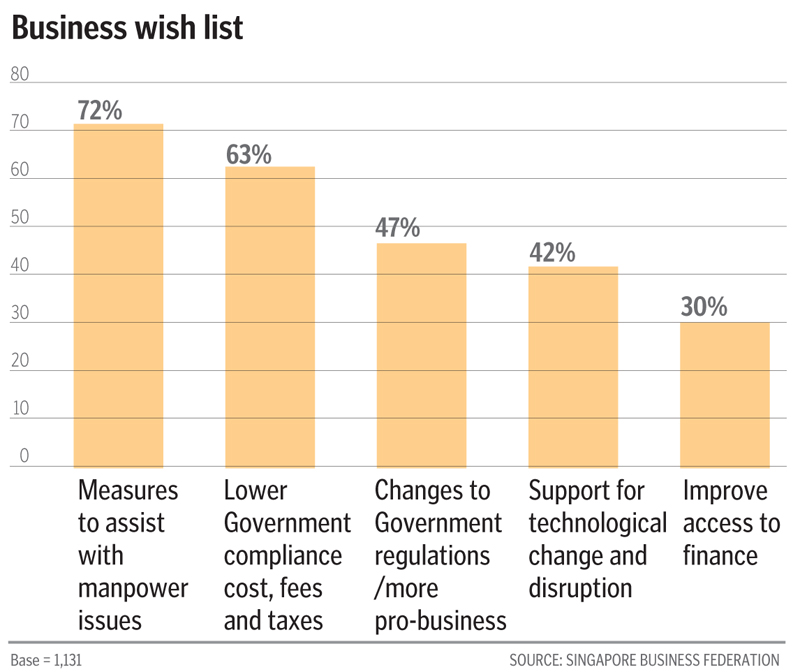

Manpower issues biggest obstacle for local firms

Manpower issues remain the biggest challenge for local firms here, according to a Singapore Business Federation survey released yesterday.

Rising labour cost is the toughest challenge for about eight in 10 companies.

Rules and regulations as well as retention of younger workers are also high-priority areas.

A survey respondent said: “It is difficult to get Singaporeans for lower skilled, more hard labour kind of jobs and these jobs cannot be automated (marine crew for example).

“However, quotas are being cut and the levy is increasing. It is also difficult to retain Singaporeans.”

Nearly half of the businesses expressed that they were neutral with current Government policies for businesses.

The high neutral scores mask a sense of disappointment with recent Government efforts, noted the survey.

More than 40 per cent of the companies identified rising compliance costs and bureaucratic hurdles as areas that they were dissatisfied with.

Associate Professor Boh Wai Fong from the Nanyang Business School pointed out that many firms feel the cost of doing business in Singapore is too high and there is a lack of financial support from banks.

“Many SMEs point out that while grants are available by Government, they involve too much paperwork.”

Streamlining the application process will definitely help the SMEs.

“They would also prefer help on cash-flow financing. Many government schemes are on reimbursement basis, but many SMEs are unwilling to pay for the upfront costs,” he said.

“Many schemes also provide payment to third parties – for example, consulting firms to do the work for SMEs.

“Maybe tying the schemes to capability development will be useful – teaching them to fish, rather than to fish for them.”

– LINETTE HENG

linheng@sph.com.sg

This article was first published on Dec 29, 2016.

Get The New Paper for more stories.