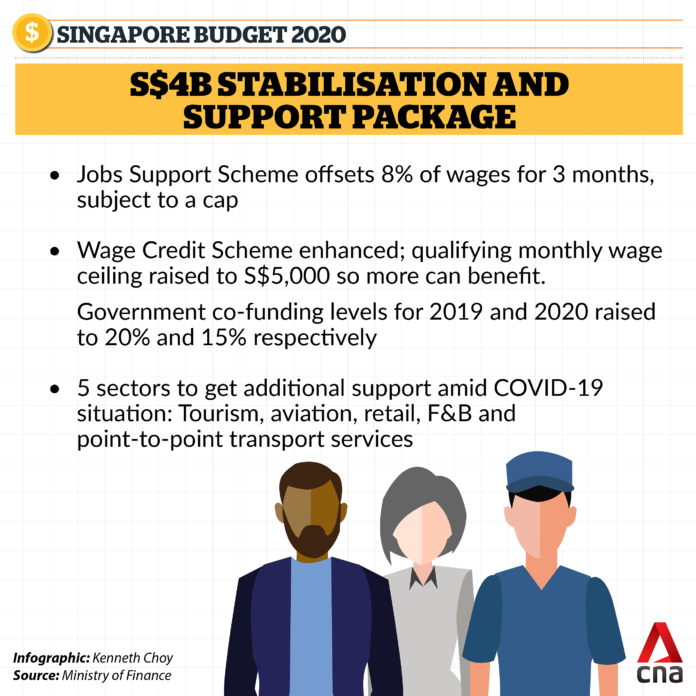

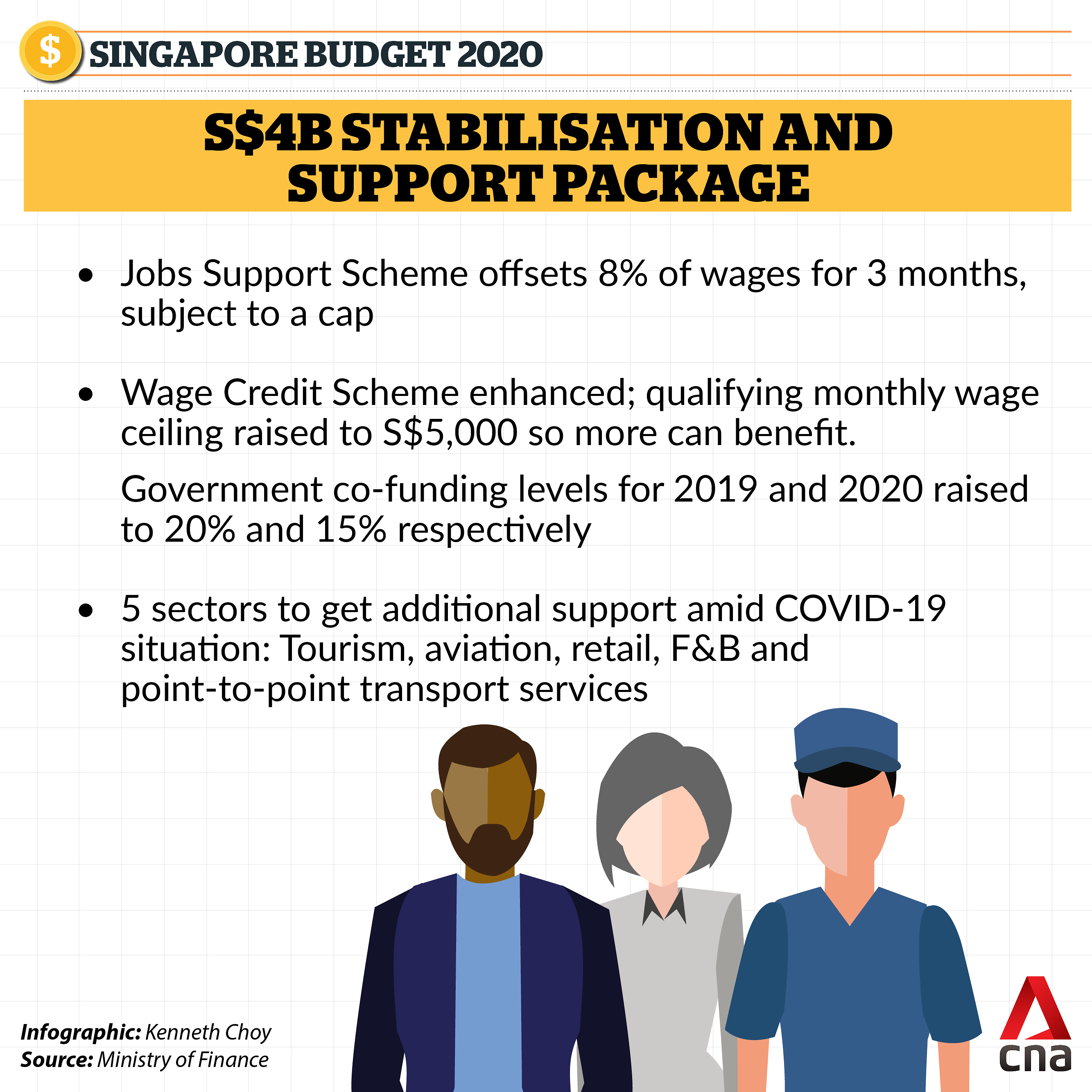

SINGAPORE: Singapore will spend S$4 billion on a slew of new measures and enhancements to existing schemes to stabilise its economy amid the near-term uncertainties caused by COVID-19, announced Deputy Prime Minister Heng Swee Keat on Tuesday (Feb 18).

The special Stabilisation and Support Package will help workers to remain employed and aid companies with cash flow.

Sectors that have taken a direct hit from the coronavirus outbreak, such as tourism, aviation, retail, and food services, will receive additional help, Mr Heng said in his Budget statement.

READ: Singapore cuts 2020 GDP forecast range to -0.5% to 1.5% due to COVID-19 outbreak

HELP WORKERS STAY EMPLOYED

Noting concerns about jobs amid the uncertainties, Mr Heng, who is also Finance Minister, said the Government wants to help workers stay employed and will do so by helping firms to defray wage costs in two ways.

The first is through a Jobs Support Scheme worth S$1.3 billion. This aims to help firms retain local workers – more than 1.9 million Singapore citizens and permanent residents (PRs) – during this period of uncertainty.

Employers will receive an 8 per cent cash grant on the gross monthly wages of each local employee on their Central Provident Fund payroll for the months of October to December. This is subject to a monthly wage cap of S$3,600 per worker. Payment to the employers will be made by end-July.

The second is an enhancement of the Wage Credit Scheme, which supports enterprises embarking on transformation efforts and encourages them to share productivity gains with workers in the form of wage increases.

The scheme currently co-funds wage increases for Singaporean employees earning a gross monthly wage of up to S$4,000. This will be raised to S$5,000 for qualifying wage increases given in 2019 and 2020 to benefit more Singaporean workers.

The Government co-funding levels will also be increased by 5 percentage points to 20 per cent and 15 per cent for 2019 and 2020, respectively.

More than 700,000 Singaporeans employed by 90,000 enterprises will benefit from these enhancements to the Wage Credit Scheme worth S$1.1 billion, said Mr Heng.

HELP BUSINESSES WITH CASH FLOW

The special package also entails economy-wide support to ease business concerns about cash flow.

There will be a corporate income tax rebate for the year of assessment 2020 at a rate of 25 per cent of tax payable, and capped at S$15,000 per company. This move, which will benefit all tax-paying firms, will cost the Government about S$400 million.

Mr Heng also announced year-long enhancements for several tax treatments under the corporate tax system.

For instance, enterprises will be allowed a faster write-down of their investments in plant and machinery, and renovation and refurbishment, incurred for the year of assessment 2021.

This will put more cash in the hands of enterprises, said Mr Heng. Hotels, for example, can take advantage of this lull period to carry out upgrading work and be better prepared for the rebound, he suggested.

To help enterprises access working capital more easily, the Enterprise Financing Scheme’s Working Capital Loan component will also be given a boost.

For a year, the maximum loan quantum will be doubled from S$300,000 to S$600,000, while the Government’s risk-share will also be increased to 80 per cent, from the current 50 to 70 per cent.

The Government will also support tenants and lessees of Government-managed properties with more flexible rental payments, such as instalment plans. For this, each request will be assessed individually, taking into account the firm’s circumstances, said Mr Heng.

READ: From manufacturing to retail, Singapore firms brace for supply issues amid COVID-19 outbreak

READ: Amid fears of 80% revenue loss due to COVID-19 outbreak, restaurants hope for rent rebates

EXTRA HELP FOR DIRECTLY-IMPACTED SECTORS

The outbreak of the novel coronavirus has directly affected sectors, such as tourism, aviation, retail, food services and point-to-point transport services.

To help firms in such sectors retain and reskill workers, the Adapt and Grow initiative will be enhanced this year, specifically through redeployment programmes.

For these sectors, the funding period for reskilling of workers will be extended from three months to a maximum of six months.

“Together with the Jobs Support Scheme, we will support employers in these sectors to retain and train more than 330,000 local workers,” said Mr Heng. “These workers can make full use of the downtime for training and upskilling to prepare for the recovery.”

The Government will also help affected sectors with their operating costs and cash flow.

Within the tourism sector, a property tax rebate of 30 per cent for the year 2020 will be granted to the accommodation and function room components of licensed hotels and serviced apartments, and three Meetings, Incentives, Conventions and Exhibitions (MICE) venues like the Suntec Singapore Convention and Exhibition Centre, Singapore Expo and the Changi Exhibition Centre.

International cruise and regional ferry terminals will receive a 15 per cent property tax rebate, while the integrated resorts will receive a 10 per cent rebate.

Firms in the tourism sector can also look forward to a temporary bridging loan programme for additional cash flow support.

Under this programme, eligible enterprises can borrow up to S$1 million with the interest rate capped at 5 per cent per annum from participating financial institutions. The Government will provide 80 per cent risk-share of these loans. The programme will start in March and will be available for a year.

For the aviation sector, the Government will grant a 15 per cent property tax rebate for Changi Airport, alongside a suite of measures including rebates on aircraft landing and parking charges, assistance to ground handling agents and rental rebates for shops and cargo agents at Changi Airport.

To support firms in the food services and retail business, the National Environment Agency (NEA) will provide a full month’s rental waiver to stallholders in NEA-managed hawker centres and markets.

Other government agencies, like the HDB, will provide half a month of rental waiver to its commercial tenants.

A 15 per cent property tax rebate will also be granted to qualifying commercial properties, said Mr Heng, who urged landlords to pass this on to their tenants by reducing rentals.

A taxi driver waits for passengers outside Swissotel The Stamford (Photo: Jeremy Long)

For the transport sector, authorities already announced a S$77 million Point-to-Point Support Package for taxi and private-hire car drivers last week. The Government will contribute S$45 million towards the package, with the remaining provided by taxi and private-hire car operators.

“We will continue to monitor the situation closely,” said Mr Heng. “If needed, we can and are prepared to do more.”

READ: S$77 million package to help taxi, private-hire drivers affected by COVID-19 outbreak

The outbreak of COVID-19 comes after a difficult 2019 where the Singapore economy posted its weakest growth since the 2008 financial crisis.

“The outbreak will certainly impact our economy,” he said, noting that the tourism and aviation industries are most affected due to declining visitor arrivals to Singapore, air traffic through Changi Airport and a decline in hotel occupancy rates.

The outbreak has also disrupted supply chains and created ripple effects on other sectors, with the economy “so much more integrated with China’s”.

Mr Heng said the duration and severity of the COVID-19 outbreak and impact on the global economy are still unclear.

Referring to an earlier downgrade in growth forecast by the Ministry of Trade and Industry, he said: “While MTI’s baseline is for GDP growth to come in at 0.5 per cent for the full year, we must be prepared that the economic impact may be worse than we projected.”

Noting that the Government will put in every effort to slow down the spread of the virus, Mr Heng said he will set aside an additional S$800 million in this Budget to do so, with the bulk set to go to the Ministry of Health.

At the start of his Budget statement, he also expressed gratitude to all frontline workers who have been working tirelessly to fight against the outbreak.

“I am confident that together, we will stay strong and get through these trying times,” he said.