SINGAPORE: Travellers entering Singapore will soon get less Goods and Services Tax (GST) relief on items bought overseas. The duty-free alcohol allowance is also being reduced.

The GST relief change will take effect from midnight on Tuesday, while the duty-free alcohol allowance change will start on Apr 1.

Finance Minister Heng Swee Keat announced this in his Budget statement on Monday (Feb 18).

Mr Heng said travellers who spend less than 48 hours outside Singapore will have to start paying GST on goods bought overseas worth more than S$100. The current allowance is S$150.

Travellers who spend 48 hours or more outside Singapore will have to start paying GST on purchases worth more than S$500, down from S$600 currently.

These changes come amid a rise in international travel, Mr Heng said.

READ: 20 mins to pay S$3 GST: Settling tax for groceries from JB means additional queuing

The relief is applicable to Singapore citizens, permanent residents and tourists. It is not applicable to crew members and holders of a work permit, employment pass, student’s pass, dependent’s pass or long term pass.

The relief also does not apply to intoxicating liquor and tobacco, as well as goods imported for commercial purposes.

LOWER ALCOHOL DUTY-FREE ALLOWANCE

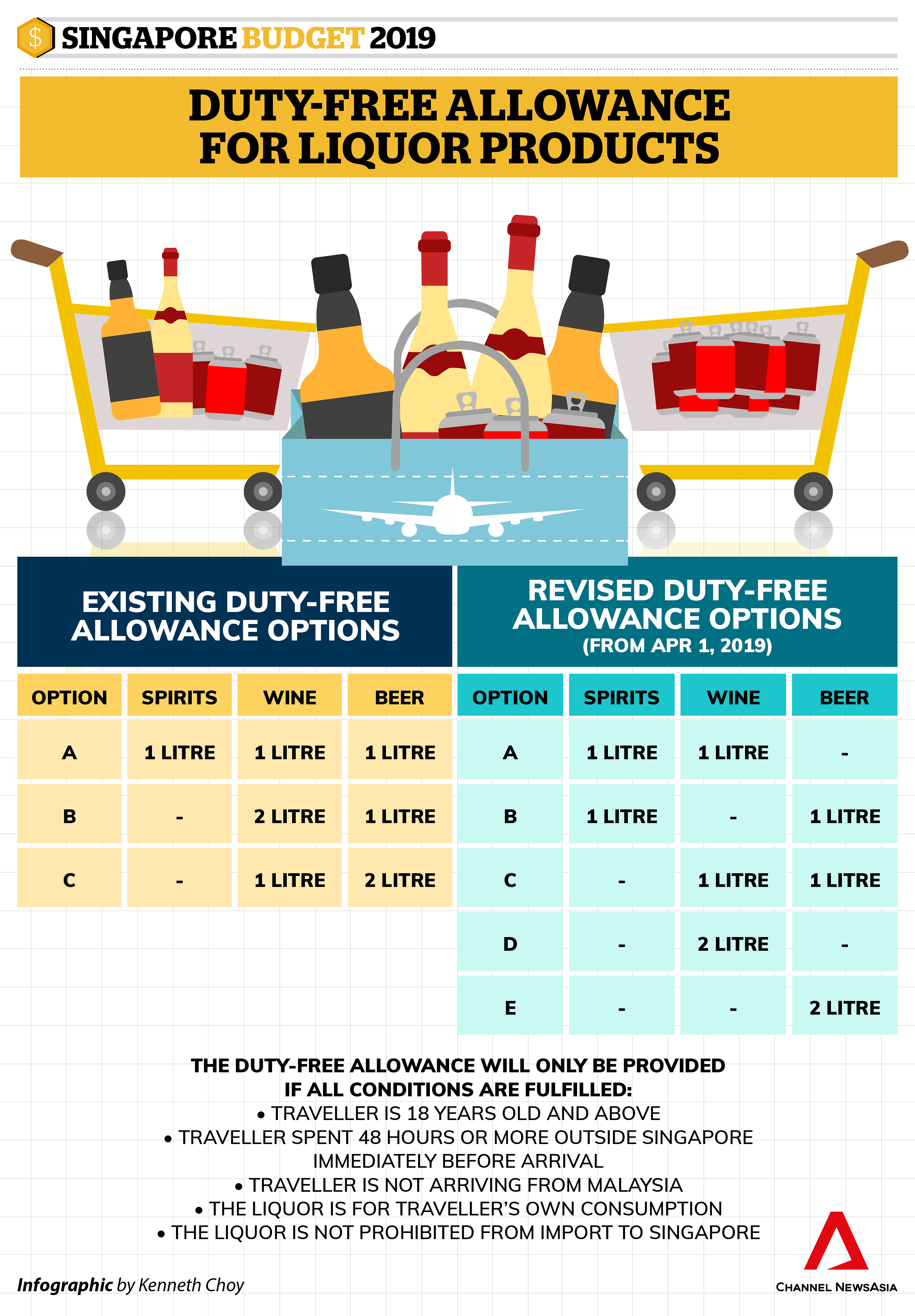

As for the alcohol duty-free allowance, Mr Heng said travellers will be able to buy two litres of duty-free alcohol, down from the current three litres.

As with the current allowance, only one litre of the duty-free allowance can be spirits.

The duty-free allowance will only be provided if the traveller fulfils all conditions. These include spending 48 hours or more outside Singapore immediately before arrival, not arriving from Malaysia and ensuring the liquor is for personal consumption.

These changes will help ensure the resilience of Singapore’s tax system, Mr Heng said. “GST is a broad-based tax that contributes significantly to our fiscal resources,” he added.

This comes after Mr Heng announced the introduction of GST on imported services in last year’s Budget statement to ensure GST collections “remain fair and resilient in a digital economy”.

READ: Budget 2018: GST to be imposed on digital services from 2020

While Mr Heng said many countries have taken the “easier route” by funding recurrent expenditures – like on healthcare, pre-school education and security – through borrowing, he added that this is “not the Singapore way”.

“We must not do this, as such borrowing shifts the burden of paying for today’s needs onto future generations,” he stated.

“A fairer and more robust approach is to meet recurrent spending with recurrent revenues. Hence, we must continually review our tax system to ensure its resilience.”