SINGAPORE: Finance Minister Heng Swee Keat delivered an expansionary Budget on Monday (Feb 18) that outlined a strategic plan “to build a strong, united Singapore”.

He said “new forces are reshaping the global environment”, and these are interacting in complex ways at the global, regional and national levels and there is a need for Singapore to chart its way forward confidently building on its distinct strengths.

As expected, details for the Merdeka Generation Package were fleshed out by Mr Heng in Parliament after it was first announced by Prime Minister Lee Hsien Loong in his 2018 National Day Rally speech.

READ: NDR 2018: ‘Merdeka Generation’ healthcare package for Singaporeans born in ’50s

Singaporeans who are born in the 1950s fall in this category of people who – as the minister said – “played a critical role” in the nation’s development and came together to forge its multicultural, multiracial society.

Among the key highlights of the package are that they will receive a MediSave top-up of S$200 each year for five years starting from 2019, while getting additional subsidies for outpatient care for life. For the latter, special Community Health Assist Scheme (CHAS) subsidies for common illnesses, chronic conditions and dental conditions will be given to all in this demographic, regardless of income, he explained.

“The Merdeka Generation Package is a gesture of our nation’s gratitude for their contributions and a way to show care for them in their silver years,” Mr Heng said.

“It will provide them better peace of mind over future healthcare costs, while helping them to stay active and healthy.”

The package, which is expected to benefit close to 500,000 Singaporeans, is estimated to cost more than S$8 billion over the beneficiaries’ lifetimes, said Mr Heng.

As such, S$6.1 billion of this Budget has been set aside – with interest accumulated over time, the amount will be able to cover the projected costs, he said.

Eligible Singaporeans will be notified by April and receive their Merdeka Generation cards from June. Health Minister Gan Kim Yong will also provide more details during the Committee of Supply debates.

BICENTENNIAL BONUS

In another nod to the country’s past, the minister also revealed two initiatives to commemorate 200 years since Sir Stamford Raffles landed on Singapore’s shores.

READ: Budget 2019: S$1.1 billion Bicentennial Bonus for Singaporeans

The first is to set aside S$200 million for a Bicentennial Community Fund, which will provide dollar-for-dollar matching for donations made to Institutions of a Public Character (IPCs) in Financial Year 2019.

“With this, we hope to further encourage more Singaporeans, including younger Singaporeans, to embrace the spirit of giving back,” he said. “At the same time, we are encouraging IPCs to reach out to more donors.”

More details will be shared by the Ministry of Culture, Community and Youth (MCCY) at a later date, he said.

The other initiative is a S$1.1 billion Bicentennial Bonus, which includes more financial assistance to lower-income Singaporeans as well as a one-off 50 per cent personal income tax rebate.

Lower-income workers who receive Workfare Income Supplement (WIS) payments, for instance, will get a Workfare Bicentennial Bonus of an additional 10 per cent of their payments for work done in 2018 – with a minimum payment of S$100 – in cash.

Parents with school-going children will also benefit through an S$150 top-up to their primary and secondary school children’s Edusave accounts. This is on top of the annual contributions they receive from the Government, he said.

Mr Heng said: “From time to time, when our finances allow, we share the surpluses with Singaporeans, and provide more help to those with specific needs. With this bonus, I hope that all Singaporeans, young and old, will join us to commemorate this significant moment in Singapore’s history.”

INDUSTRY IMPETUS

Mr Heng also outlined how the Government intends to meet future challenges, and ensure that Singapore firms and workers remain competitive and stay relevant to the world.

He said Singaporeans are making “good effort” to invest in their learning, with the percentage of residents in the labour force who participated in training growing from 35 per cent in 2015 to 48 per cent in 2018.

More than 76,000 jobseekers found employment through the Adapt and Grow initiative from 2016 to 2018, he added.

Going forward, the Government will launch new Professional Conversion Programmes (PCPs) relating to blockchain, embedded software and prefabrication to prepare Singaporeans to move into new growth areas, the minister said.

Yet, he also highlighted that productivity growth has been uneven across sectors. The manufacturing sector, for example has done well despite strong global competition.

In the services industry, however, while some firms have done well, other segments such as food and beverage (F&B) and retail remain very labour-intensive, he said.

The industry has also seen the number of S Pass and work permit-holders rise by about 3 per cent a year, or 34,000 in the last three years.

If this foreign manpower growth trend continues, it may become “unsustainable”, Mr Heng said.

READ: Budget 2019: Foreign worker quota in services sector to be cut to 35% by 2021

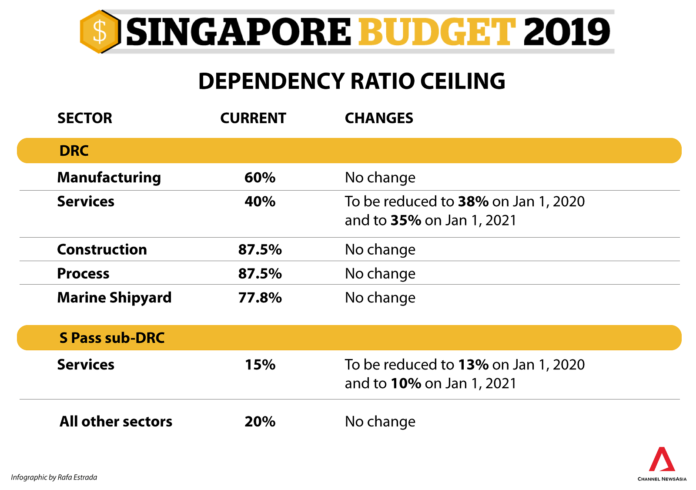

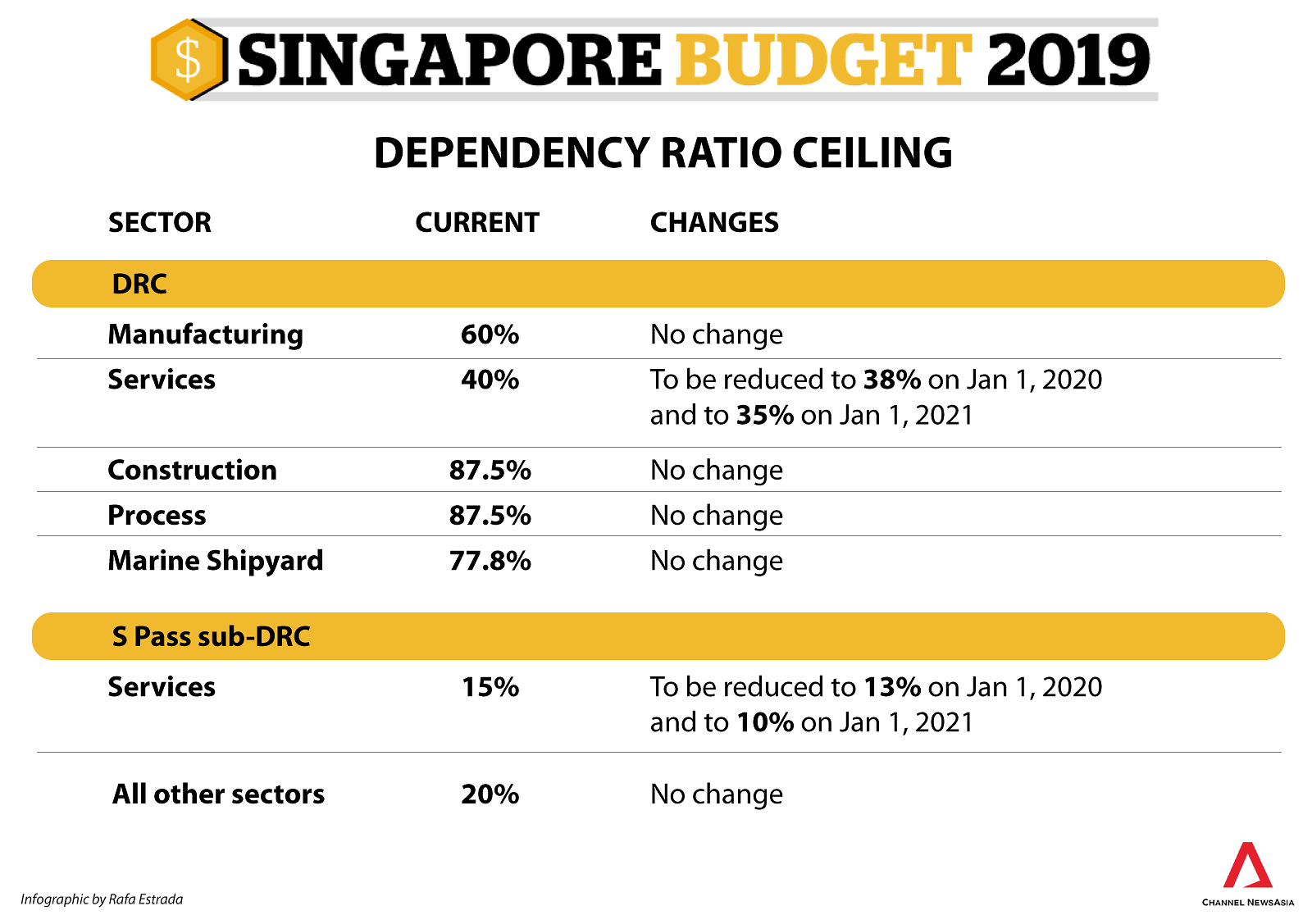

As such, the Government is adjusting the workforce quota for the services sector in two ways: Reducing its Dependency Ratio Ceiling (DRC) and its S Pass sub-DRC over two years from 2020.

“The Government recognises the economic headwinds and cost pressures ahead of us,” he said. “But if we do not take action early, our firms will find it harder to compete in the years ahead and our workers will be left behind.”

There will be steps to support these companies as they adjust, such as extending the 70 per cent funding support level for the Enterprise Development Grant for three more years to March 2023, the minister said.

He said about S$4.6 billion is expected to be spent over the next three years on the new and enhanced economic measures announced in this budget.

Reduction in Dependancy Ratio Ceiling (DRC).

READ: Budget 2019: More support for lower-wage, older workers; enhanced CHAS subsidies at GPs

HEALTHCARE HELP

Another area that the Budget focused on is healthcare.

Mr Heng announced that the CHAS subsidies at general practitioner (GPs) clinics will be enhanced in three ways. The first will see CHAS subsidies extended to cover all Singaporeans for chronic conditions, regardless of income. Lower- to middle-income Singaporeans who hold CHAS Orange cards will see subsidies for chronic illnesses extended to include common illnesses too.

Subsidies for complex chronic conditions will also be increased, he said.

He pointed out that CHAS clinics need to deliver good outcomes too, so the Ministry of Health (MOH) will be looking at how to help these clinics better track their patients’ progress and outcomes. MOH will also review its clinical guidelines for care provided at CHAS dental clinics, he added.

The finance minister also detailed plans to strengthen financial protection for long-term care.

He noted that MOH has previously announced it will introduce the new CareShield Life from 2020, which is an enhancement to the current ElderShield scheme.

There will also be a new ElderFund scheme launched next year to help severely disabled, lower-income Singaporeans who need additional financial support for long-term care, he said.

With these in mind, Mr Heng said he will set aside another S$3.1 billion in this Budget, in addition to the S$2 billion earmarked last year, with the total sum of S$5.1 billion to be put into a new Long-Term Care Support Fund to help fund the initiatives mentioned above.

“This is a significant commitment to help Singaporeans with their long-term care needs,” he said.

TACKLING CLIMATE CHANGE

Mr Heng also took time to outline how the Government is preparing the country for climate change, including the Climate Action Plan launched in 2016.

“Climate change and rising sea levels threaten our very existence,” he said. “As a low-lying nation, there is nowhere to hide when sea levels rise.”

He said in line with the Climate Action Plan, low-lying roads near coastal areas have been raised, while Changi Airport Terminal 5 will also be built at 5.5 metres above mean sea level.

But to protect Singapore against these threats, Mr Heng said it will have to invest more; together with existing infrastructure needs, the total bill for infrastructure will increase significantly.

Looking forward, the minister said the carbon tax will be applied on this year’s emissions.

READ: Zero Waste Masterplan to focus on electronics, packaging, food waste, says Masagos

Additionally, the Zero Waste Masterplan will be introduced in the second half of this year to look at things such as better management of food waste, electronic waste and packaging waste including plastics, he said.

The minister also mentioned that the Government has seen “positive results” since introducing measures to reduce diesel consumption here in 2017.

To continue such efforts, he announced that the excise duty for diesel will be raised by S$0.10 per litre to S$0.20 per litre with immediate effect and the annual special tax on diesel cars and taxis to be permanently reduced by S$100 and S$850, respectively.

FISCAL PLANS

Finally, the minister shed light into how the Government plans to fund the initiatives in this year’s Budget. He said it will pursue new investments using a differentiated fiscal strategy, taking one approach for major infrastructure investments and another for recurrent social and security spending.

On infrastructure investments, which he said are “large and lumpy” and where benefits span many generations of Singaporeans, paying for them through some borrowing is fairer and more efficient, he said.

Citing the Changi East development as example, he said the Changi Airport Group will be taking up loans to fund its share of the infrastructure investments.

To lower financing costs, the Government will provide a guarantee for Changi East borrowings, with the concurrence of President Halimah Yacob, he said.

“This allows us to tap on the strength of the Government’s balance sheet to back this strategic investment,” Mr Heng explained, adding it is further studying the option of using government debt as part of the financing mix for long-term infrastructure projects that it will be taking on directly.

For recurring spending in areas such as healthcare, pre-school education and security, the minister said a fairer and more robust approach is to meet them with recurrent revenues, which is why Singapore’s tax system must continually be reviewed.

In addition to the impending increase of GST from 7 per cent to 9 per cent and introducing GST for imported services, Mr Heng said he will tighten the GST import relief for travellers as well as their alcohol duty-free concession from three litres to two litres.

BUDGET DEFICIT FOR FY19

For FY2018, the Government expects an overall budget surplus of S$2.1 billion, or 0.4 per cent of the overall Gross Domestic Product (GDP). This, he said, is a S$2.7 billion increase from the S$600 million deficit projected a year ago due to the “unexpected two-year suspension of the Kuala Lumpur-Singapore High-Speed Rail project and higher-than-expected stamp duty collections”.

Excluding Government top-ups to funds and Net Investment Returns Contribution from past reserves, Mr Heng said a basic deficit of S$7 billion, or 1.4 per cent of GDP, is expected – making it an expansionary Budget.

For FY2019, he said the Government’s position remains expansionary with a basic deficit of S$7.1 billion and, on the whole, expecting an overall budget deficit of S$3.5 billion, or 0.7 per cent of GDP. The ministries’ total spend is expected to be S$80.3 billion in the coming financial year, 1.6 per cent higher than the previous year.

“We have sufficient fiscal surplus accumulated over this term of Government to fund the overall deficit in FY2019. There is no draw on past reserves,” the minister said.