SINGAPORE – To help Singaporeans tide through the economic slowdown, the Government announced on Thursday (March 24) that it will be giving out a one-off Goods and Services voucher (GSTV).

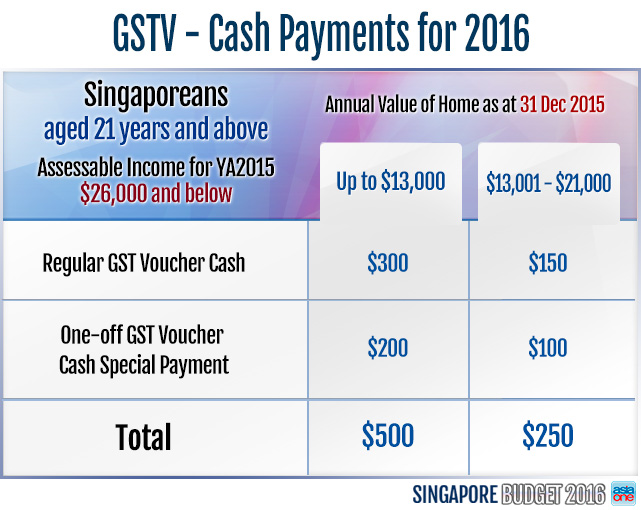

The “cash special payment” will range from $100 to $200 depending on household type, and will be on top of the regular GST voucher.

Finance Minister Heng Swee Keat said in his Budget speech earlier today that the one-off GSTV, which will benefit some $1.4 million Singaporeans, will cost the Government an additional $280 million in 2016.

While the regular GST voucher is typically distributed in August, this cash special payment will be paid out in November.

Eligible are Singaporeans aged 21 years and above with assessable income not more than $26,000 in 2015.

Here’s an example of what those eligible will be getting with the addition of the one-off GSTV:

Service & Conservancy Charges (S&CC) Rebate

Meanwhile, the Government will also provide one to three months of Service & Conservancy Charges (S&CC) rebate.

1- and 2-room HBD households will receive a total of three months of rebates for this year, while 3- and 4-room households will receive two months of rebates.

This will cost the Government $86 million and benefit about 840,000 HDB households.

Personal Income Tax Relief changes

Minister Heng also said the Government will make a tax change in 2018 Year of Assessment to introduce a cap on the total amount of personal income tax relief that an individual can claim.

He explained that the change is so that the current 15 personal income tax reliefs – which have been enhanced over the years – will not “unduly reduce total taxable incomes for a small proportion of individuals”.

The cap will be set at $80,000 per Year of Assessment, to which Minister Heng said will not affect 99 per cent of tax-resident individuals.

This move is expected to raise an additional $100 million a year for the Government.

“This cap will make our personal income tax system more progressive. Nevertheless, our personal income tax burden remains low. Our personal income tax structure must allow us to continue to stay competitive,” he said.

maryanns@sph.com.sg