Finance Minister Heng Swee Keat delivered his maiden Budget speech in Parliament today.

Here are some important announcement he made earlier today that is important to you as a SME or startup owner.

Minister Heng shared that there are three main thrusts for this year’s Budget, which includes: Addressing cyclical weaknesses, enabling firms to build more capabilities, as well as supporting people through change.

Budget 2016 – Announcements which are relevant for start-ups:

1. Wage Payout Scheme – Firms will continue to enjoy the Wage Credit Scheme. Under the Scheme, the Government will co-fund 40 per cent of wage increases given to Singapore Citizen employees earning a gross monthly wage of $4,000 and below in 2013 – 2015. Only Employers are eligible for the co-funding. This month alone, Minister Heng shared that firms will receve a total of S$1.9 billion in wage credit payout, the largest payout to date.

2. Corporate income tax relief will be increased to from 30 per cent to 50 per cent, though it is capped at S$20,000. This is to help SMEs in Singapore to tide through the tough economy. The higher percentage rebate is targetted at SMEs.

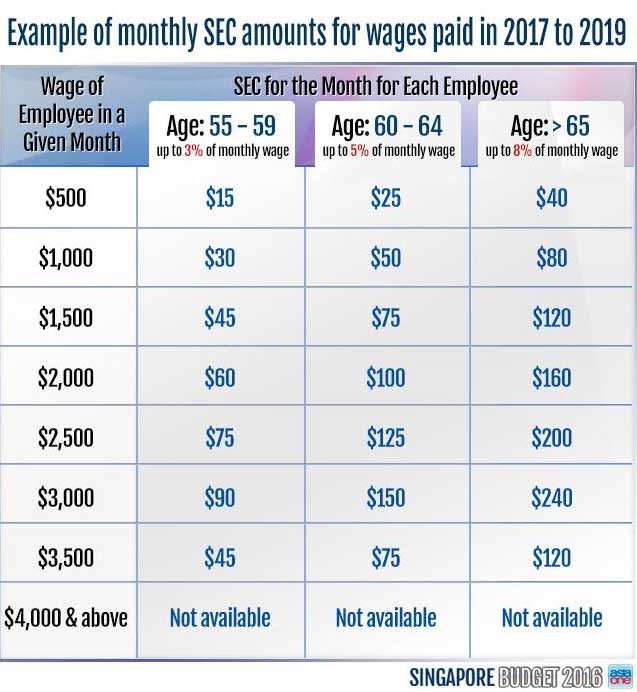

3. The Special Employment Credit will also be extended for 3 years until 2019. Under the scheme, employers enjoy wage offsets up to 8 per cent when they hire Singaporean workers aged 55 and above, and earning up to $4,000 a month.

4. Singapore is also launching a new SME Working Capital Loan scheme for loans up to S$300,000 per SME. The government will co-share 50 per cent of default risk of such loans. This is to spur confidence among banks and capital institutions to provide more capital loans to companies who need them.

DBS also recently launched a collateral free business capabilities loan, which is a bridging finance solution to support government grant scheme.

5. Singapore is focusing on a new Industry Transformation Programme focusing more on tech adoption and partnership.

“There is no such thing as a sunset industry. There’s only sunset thinking.” – Minister Heng.

6. There will be a new business grants portal, slated to be launched end of this year. The new portal will make it easier for firms to apply for schemes. Firms of all sizes can go to this portal to find out which schemes apply to them.

“Firms will not need to go from agency to agency, to find out which grants are available to them,” Minister Heng.

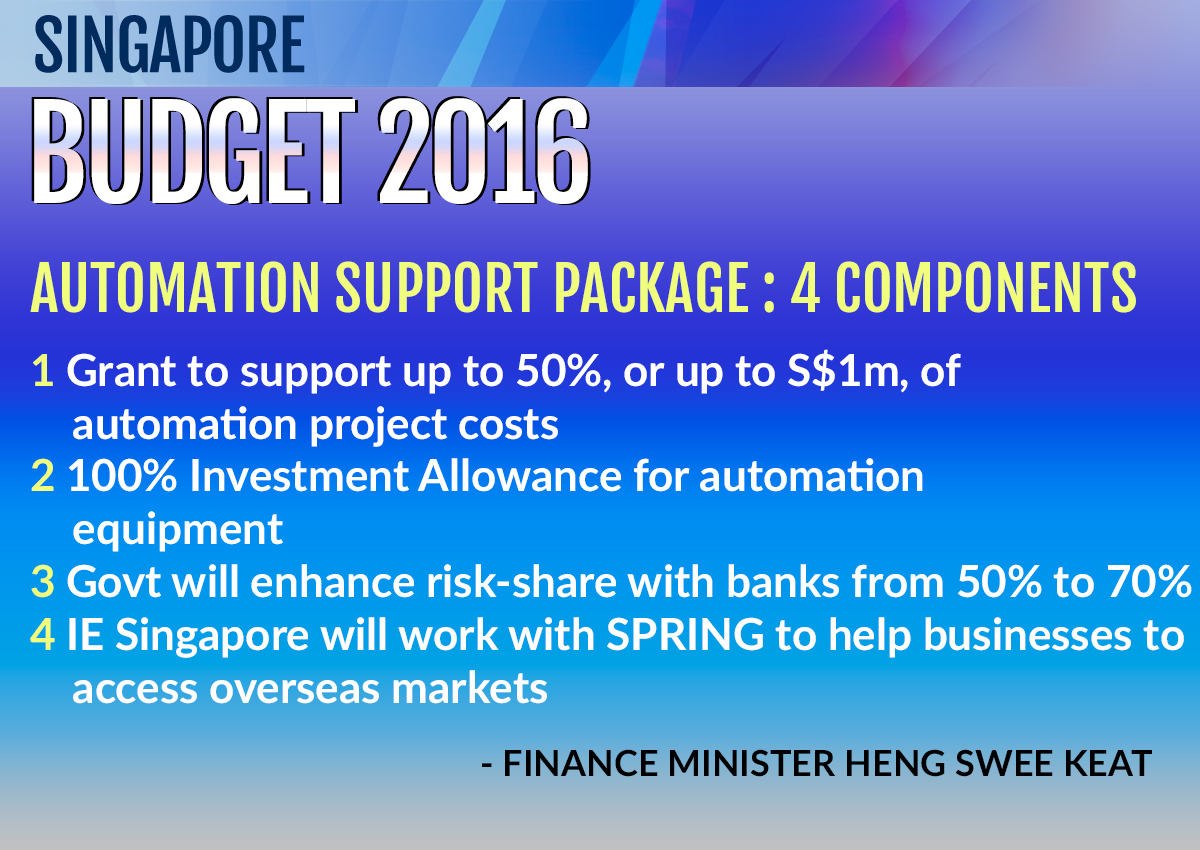

7. The government is also pushing for firms to automate their business processes. There will be a new support package which will fund up to 50 per cent of project automation cost if the project is approved. This is capped at S$1,000,000 per project. There’s also a 100 per cent investment allowance for automation equipment.

8. The government topping up the SME Mezzanine Growth Fund up from S$100m to S$150m to help SMEs scale up and internationalise. SPRING and IE Singapore tasked to help businesses access overseas markets. In 2016, IE Singapore expects to help 35,000-40,000 companies to venture overseas, up from 35,000 firms last year.

9. Government announced a S$450 million National Robotics Programme – S$450 million has been allocated to promote and scale up the robotics sector in Singapore. This is great news for startups in the robotics sector.

10. Government is also allocating up to S$4 billion in Research, Innovation and Enterprise (RIE) 2020 Plan for industry-research collaboration. There’s a top-up of S$1.5 billion to National Research Fund.

11. There will be a new initiative: “SG Innovate” which will match budding entrepreneurs to mentors. “The startup scene is now more vibrant than ever before” – Minister Heng. No details on SG Innovate is available yet.

12. PIC cash payout to drop to 40 per cent for expenses incurred on or 1 August 2016. 400 per cent tax deductions under PIC scheme remain unchanged; scheme will retire as planned and there will be no extension.

13. The newly announced Jurong Innovation District will be “industrial park of the future”. It will ” transform how we live, work, play or create.” It will integrate NTU and its surrounding areas. JID will be housing R&D and prototyping labs, “maker’s spaces” and self-driving vehicles, among others. The first phase will JID targeted for completion in 2022.

So there we have it, some of the most important important regarding SMEs and the start-up ecosystem in Singapore. We are particularly excited about the upcoming JID, though it will only be completed in 2022. We are also excited about the possibilities of the robotics industry in Singapore.

Vulcan Post is all about living life with a digital edge, up and coming startups, and people who inspire conversations.

Visit Vulcan Post for more stories.