Minister for Finance Heng Swee Keat delivered the Singapore Budget 2016 on Thursday afternoon, marking the start of a new lap in Singapore’s journey to transform its economy through enterprise and innovation as well as to build a caring and resilient society.

In his speech delivered in Parliament, Mr Heng touched on the state of regional and international affairs in December 1965 when the then-Finance Minister Mr Lim Kim San presented the first Budget of the independent Republic of Singapore and how the country has developed since the challenges of that era.

“Today, we are in a much better position than our pioneers. But we also face new responsibilities, new challenges.” he said.

He set out four broad strokes for Singapore’s goals ahead: To grow the country’s economy; to invest in education and health; to invest in better liveability and connectivity and also to invest in security to keep Singapore safe.

Here are some new initiatives he announced:

For businesses and small and medium enterprises (SMEs):

– The existing Corporate Income Tax (CIT) Rebate will be raised from 30 per cent of tax payable to 50 per cent of tax payable, with a cap of $20,000 rebate each year for Year of Assessments 2016 and 2017.

– The Special Employment Credit ((SEC), which is due to expire this year, will be modified and extended for three years until the end of 2019. This is to provide employers with a wage offset for workers aged 55 and above who earn up to $4,000 monthly. Employers with Singaporean workers aged 65 and above will continue to receive a wage offset of up to 8 per cent, while the SEC will be up to 5 per cent for workers aged 60 to 64 and up to 3 per cent for those aged 55 to 59.

– An SME Working Capital Loan scheme, for loans of up to $300,000 per SME will be introduced. Under this scheme, the Government will co-share 50 per cent of the default risk of such loans with participating financial institutions, to encourage lending to SMEs. It will be available for three years.

– Levy increases for work permit holders in the Marine and Processes sectors will be deferred for one year. Work permit levies in the Manufacturing sector will remain unchanged for another year.

– Work permit holders in the Services and Construction sectors, as well as S Pass holders in every sector will see levy increases, as announced in the previous budget.

– The Business Grants Portal will be launched in the fourth quarter of the year. It will be organised along core business needs of capability building, training and international expansion. With it, firms will not need to go to various Government agencies to figure out which schemes apply to them.

– The Government will offer a new Automation Support Package for an initial period of three years in order to support the roll-out or scaling up of automation projects. These projects will be funded at up to 50 per cent of project cost, with a maximum grant of $1 million.

– The SME Mezzanine Growth Fund will be expanded from the current fund size of $100 million to a total fund size of up to $150 million. It is aimed at providing more capital to support SMEs to scale up and internationalise.

– Singapore will focus on a new Industry Transformation Programme to drive the adoption of technologies such as robotics as well as partnerships.

– Over $450 million will be made available to support the National Robotics Programme over the next three years.

– A new Local Enterprise and Association Development (Lead) programme called Lead-Plus will help to strengthen the outreach of trade associations and chambers (TACs). Up to 20 public officers will be seconded to interested TACs over the next five years.

– The Jurong Innovation District will be launched to create an environment to house different activities within a single, next-generation industrial district.

– The cash payout rate under the Productivity and Innovation Credit (PIC) scheme will be lowered from 60 per cent to 40 per cent for expenditures incurred on or after Aug 1 this year. The scheme which has been extended to Year of Assessment 2018, will expire thereafter.

For workers:

– The Manpower ministry (MOM) will enhance employment support through the “Adapt and Grow” initiative. For examples, wage support schemes will be expanded to encourage firms to hire workers who face greater difficulty in finding jobs such as those affected by retrenchments or business restructuring.

– New professional conversion programmes will be stepped up for mid-career job seekers and retrenched professionals in sectors such as Design as well as Information and Communications Technology (ICT).

– A new skills development and job placement hub for the ICT sector called the TechSkills Accelerator will be set up to enable workers to learn skills in the sector quickly.

For families and young children:

– A new Child Development Account (CDA) First Step grant will be introduced for all Singaporean children born from March 24. Parents will automatically receive $3,000 in their child’s CDA, which they can use for their children’s healthcare and childcare needs.

– The Medisave withdrawal limit for pre-delivery medical expenses will also be doubled from $450 to $900 with immediate effect.

– A new pilot initiative called KidSTART for children up to the age of six will be be started to help children who need more support for a good start in life. It will draw together government and community resources to help these children receive appropriate learning, developmental and health support. About 1,000 children are expected to benefit from this.

– The Fresh Start Housing Scheme will provide a grant of up to $35,000 for families with young children who previously bought a flat, sold it and are now living in public rental flats. The scheme will help such families to own a 2-room flat with a shorter lease.

For youths:

– A new Outward Bound Singapore campus will be built on Coney Island and is expected to be ready around 2020.

For those on the Workfare Income Supplement (WIS) Scheme:

– The qualifying income ceiling will be raised from the current average wage of $1,900 a month, to $2,000 a month. – Eligible workers will receive higher WIS payouts, and this will vary depending on their age and income.

– WIS will now be paid for every month worked, as part of the qualifying criteria, so workers can receive WIS payments more quickly – monthly rather than quarterly.

For persons with disabilities:

– Those with disabilities who earn low wages and are under 35 years in age, will be eligible for the Workfare Training Support scheme.

For seniors:

– Three criteria will be used in combination under the Silver Support Scheme to identify those who are of the bottom 20 to 30 per cent of Singapore’s seniors. These criteria comprise lifetime wages, housing type and the level of household support. Eligible seniors will receive between $300 to $750 every quarter, depending on their housing type.

For households:

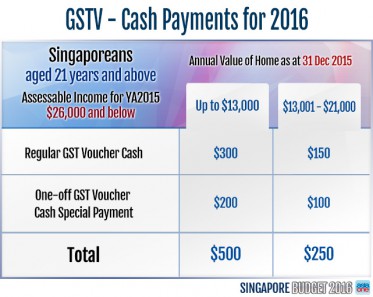

-The Government will provide a one-off GST Voucher-Cash Special Payment of up to $200 for eligible recipients.

– Between one to three months of Service & Conservancy Charges rebates will be offered, depending on housing type, and will benefit about 840,000 Housing Board households.

– A cap of $80,000 per Year of Assessment will be introduced on the total amount of personal income tax relief an individual can claim.

sujint@sph.com.sg