Budget 2016 is a prudent one, aimed at balancing the short-term economic concerns with long-term challenges. But it is also a Budget that seeks to take care of those who may be left behind in the restructuring of the economy while fostering a sense of community spirit. The Straits Times’ Janice Heng, Charissa Yong and Aaron Low wrap up some of the Budget’s priorities in this special guide.

1. Tackling challenges in the longer term

While short-term concerns were addressed, Finance Minister Heng Swee Keat was squarely focused on the longer-term challenges.

He rolled out a $4.5 billion Industry Transformation Programme, with measures aimed at fostering innovation, buffing up smaller firms and helping companies use automation.

The Automation Support Package will help subsidise up to 50 per cent of a project, capped at a maximum of $1 million, that aims to scale up the use of automation in their operations. This will cost $400 million over three years.

A new online business portal that will help businesses find the right government grant for their needs will also be up and running by the end of this year.

There will also be a new $100 million national trade platform that will cut costs and raise productivity for firms in the trade sector. Firms looking to expand overseas were also given a leg up with an extension of a double tax deduction scheme.

“We must come together as partners to transform our economy through enterprise and deeper innovation,” said Mr Heng.

2. Short-term relief for companies

Companies looking for help to cope with the short-term woes of a slowing economy got a boost in the Budget.

Finance Minister Heng Swee Keat said the Government will ramp up spending in healthcare, security, education and urban development sectors. These should generate demand for companies in these sectors.

He also rolled out an enhanced corporate income tax rebate which will rise to 50 per cent of tax payable, up to a cap of $20,000. This will cost the Government an additional $180 million.

Mr Heng also cautioned against becoming too pessimistic, noting that this is not 2009, when there was a deep recession. He gave the assurance that the Government will monitor the situation.

3. Investing heavily in skills upgrading

People will be at the heart of the economic transformation and the Government pledged to continue investing heavily in boosting workers’ skills.

It will continue to push ahead with the SkillsFuture programme, which aims to equip workers with skills for the future.

For those affected by retrenchments, support will come in the form of expanded wage credit schemes through the Adapt and Grow initiative. Firms hiring older workers and disabled workers will also get enhanced Special Employment Credit wage subsidies.

Avenues will be opened up to help people pick up skills quickly so they can get good jobs in the fast-growing information and communications technology sector in a new TechSkills Accelerator.

4. No change to property cooling measures

If there was one big announcement that was eagerly anticipated, it was on whether the property cooling measures will be lifted.

But there was no change.

Finance Minister Heng Swee Keat reiterated the Government’s stance on the property market since measures were rolled out to prevent frothy speculation in real estate.

“These are intended to keep the market stable and sustainable,” said Mr Heng, referring to the measures rolled out progressively from 2010.

“Based on the price level and current market conditions, our assessment is that it is premature to relax these measures.

“We will continue to monitor developments in the property market closely.”

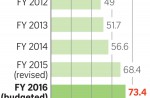

5. $3.4 billion surplus expected this year

Thanks to higher operating revenue and a bumper $14.7 billion Net Investment Returns Contribution (NIRC), a solid surplus of $3.4 billion is expected this year.

The amount represents 8 per cent of gross domestic product.

Operating revenue rose 6.7 per cent to hit $68.4 billion, due to one-off factors such as vehicle-related revenues.

More significantly, revenue contributions from Temasek Holdings have been added to the NIRC framework starting this year.

This will be a source of revenue for the long term, noted Finance Minister Heng Swee Keat.

The NIRC framework allows the Government to tap up to half the long-term expected real returns on investments by the GIC, Monetary Authority of Singapore, and now Temasek.

This took the NIRC to $14.7 billion this year, up 48.6 per cent from last year’s $9.9 billion.

All this more than makes up for an expected $5 billion or 7.3 per cent rise in total spending.

But the longer-term picture will grow more challenging, with spending needs expected to grow faster than revenues, he warned.

6. Silver Support payouts for seniors

This July, three in 10 elderly citizens will get the first payouts under the Silver Support Scheme.

Some 140,000 Singaporeans aged 65 and above will get $300 to $750 every three months.

Those living in smaller flats get more. The first payout will be a double payment for six months from April to September. First announced in August 2014, the scheme supplements the retirement income of needy seniors.

There is no need to apply for the scheme as eligible seniors will be automatically included.

Three factors determine whether an elderly Singaporean is eligible. To qualify, a person must not have contributed more than $70,000 to his Central Provident Fund savings by age 55.

If a person or his spouse owns a five-room or larger HDB flat, or any private property, he will not qualify.

Eligible seniors must be from households where the average monthly income per household member is no more than $1,100. The scheme will cost close to $320 million in this first year.

Mr Heng also announced plans for a community network to provide seniors with greater support for their health and social needs. A pilot scheme will be launched in a few areas, which could be scaled up later, he said.

7. Help for families with children

A new $3,000 grant will be automatically credited to the Child Development Account (CDA) of any Singaporean child born from yesterday onwards.

This CDA First Step grant can be used for healthcare and childcare needs.

Children from vulnerable families will also be given a leg up.

About 1,000 children aged six and below can benefit from a new programme called KidStart, which will give them learning, developmental and health support.

Second-timer families with young children who live in rental flats can also get a grant of up to $35,000 to buy a two-room home.

Parents must demonstrate they are putting in effort by staying employed and making sure that their children attend school.

8. ‘Industrial park of the future’ in Jurong

An industrial park that extends beyond manufacturing and a body to help start-ups are among the Government’s new initiatives to promote innovation.

The new Jurong Innovation District will bring together facilities for learning, research, innovation and production to form an “industrial park of the future”, said Mr Heng.

Comprising Nanyang Technological University, CleanTech Park and the surrounding region, the district could host over 100,000 people across student and private residences, learning spaces, and start-up and research facilities. The first phase is expected to be completed in 2022.

A new SG-Innovate body will also be set up to help start-ups. It will match them with mentors, introduce them to venture capital firms and help them go abroad.

9. New $250m OBS campus on Coney Island

A new campus of the Outward Bound Singapore (OBS) adventure school will be built on the rustic Coney Island in Singapore’s north-east.

This would give many more young people the chance to go for an OBS expedition.

“To thrive, our young people need a sense of adventure, resilience, and be ready to challenge themselves to be their best,” said Mr Heng.

The $250 million campus is expected to be ready around 2020.

A fund of up to $25 million will also be set up to support ground-up projects by passionate citizens who want to build the Singaporean spirit.

Called Our Singapore Fund, it will be ready by the second half of this year.

10. More cash assistance for needy households

Singaporeans permanently unable to work or support themselves will get a higher monthly cash allowance under the Public Assistance scheme.

For instance, a two-person household with both on public assistance can get an extra $80 a month, bringing their total amount of cash assistance a month to $870.

More details will be announced next month when Parliament debates the budgets of various ministries.

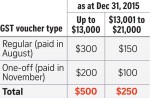

Eligible households will also receive from $250 to $500 in goods and services tax (GST) cash vouchers to help offset the cost of living. This comprises up to $300 in a regular cash voucher to be paid in August, and up to $200 from a one-off cash voucher to be paid in November.

“If our recipients spend some of these in our neighbourhood shops, it will support our local businesses as well,” said Mr Heng.

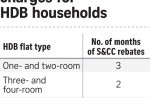

About 840,000 households in Housing Board flats will also get between one and three months of service and conservancy charge rebates. This will cost $86 million.

This article was first published on March 25, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.