Singapore: According to data from the Housing and Development Board (HDB) on Friday (October 22), resale transactions in the public housing market in the third quarter of this year increased by 19.4% over the previous quarter.

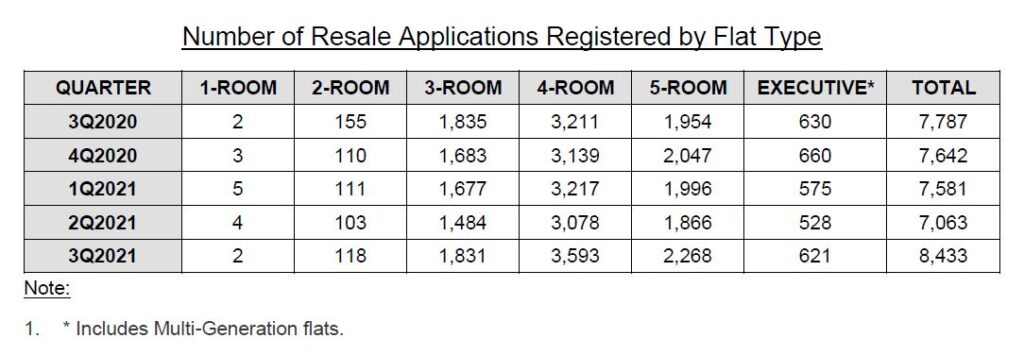

Between July and September, 8,433 HDB resale transactions were recorded, which was higher than the 7,063 applications in the second quarter.

Resale prices also increased in the third quarter, up 2.9% from the second quarter. This is slightly higher than the 2.7% flash memory estimate issued by the HDB earlier this month.

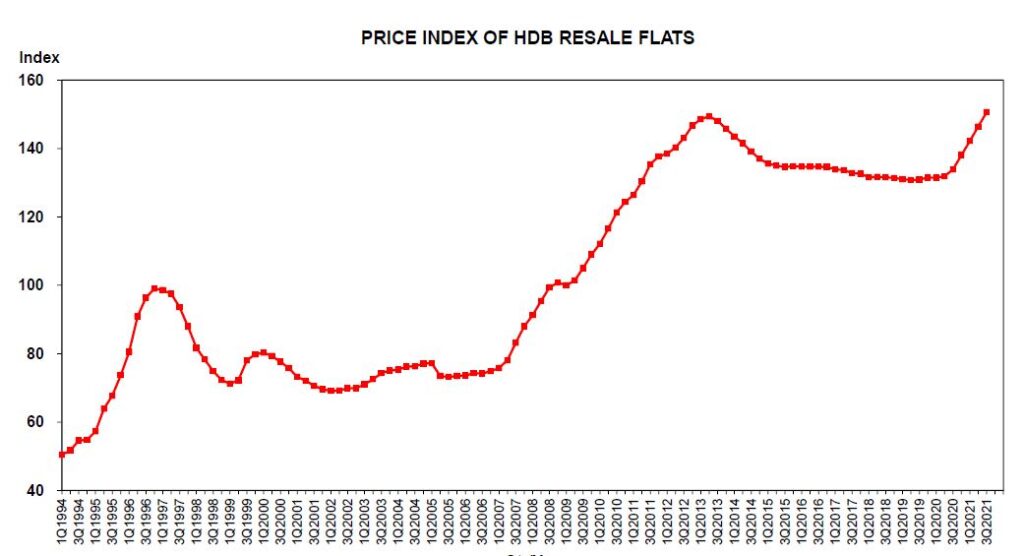

According to data from the Housing Authority, the resale price index, which provides information on overall price changes in the resale public housing market, rose from 146.4 to 150.6.

This is higher than the previous peak of 149.4 recorded in the second quarter of 2013.

Ms. Christine Sun, senior vice president of research and analysis at OrangeTee & Tie, said that the public housing sector has been “hot”.

“Last quarter, outstanding sales drove the price of resale apartments to record highs. As demand exceeds supply in many areas, house prices are pushing new boundaries,” she added.

“In addition, due to the delay in the construction of new BTO condominiums, economic recovery, low mortgage interest rates and demand for new buyers have supported the market boom.”

In terms of apartment types, four-bedroom apartments are the most popular, with 3,593 resale applications for this category in the third quarter. This was followed by 2,268 applications for five-bedroom units and 1,831 transactions for three-bedroom units.

In the leasing market, HDB approved 10,417 applications for rental apartments in the third quarter, a decrease of 5.1% from the 10,979 applications in the second quarter.

As of the end of the third quarter, a total of 57,321 HDB flats were rented out, a decrease of 0.8% from 57,755 in the previous quarter.

“As Singapore reopens its borders and establishes more vaccinated tourist routes, we may expect more Singaporeans, permanent residents and foreigners to return. Many companies may also increase recruitment of foreign nationals, which will stimulate leases. Demand,” Ms. Sun said.

In November, HDB will provide about 4,400 build-to-order (BTO) units in Choa Chu Kang, Hougang, Jurong West, Kallang Whampoa and Terengganu. These projects are under review, and more details will be announced when they are ready.

The HDB stated that it is expected to launch about 17,000 BTO units this year, which is higher than the 14,600 and 16,800 units launched in 2019 and 2020, respectively.

Including about 5,300 units of sales balance unit activities and public reservations, a total of 22,300 units will be provided this year.

“The HDB will continue to increase the supply of units to a higher level and launch more than 17,000 units in 2022 to meet strong demand,” it said.

This includes approximately 2,000 to 3,000 BTO units in Geylang, Denga and Yishun in February. The Housing and Development Board said that the supply is subject to review and more details will be determined closer to the launch date.

Looking ahead, Ms. Sun said that “strong buyer demand and still lagging supply” is expected to keep prices rising, although the pace will slow next year.

“As Singapore develops an epidemic roadmap to transition the country to the new normal, the restrictions on COVID-19 may be further lifted in the coming months. Relaxing viewing restrictions may release more pent-up demand from buyers who have been waiting. Check the actual unit before confirming the purchase,” she added.