SINGAPORE: Banks in Singapore said they have responded with measures to assist victims after a series of fraudulent Apple iTunes transactions affected dozens of account holders.

The victims reported that hundreds to thousands of dollars were wiped from their debit accounts and charged to their credit cards from banks including Oversea-Chinese Banking Corporation (OCBC), DBS and HSBC.

Apple Singapore, on Friday (Jul 20), told Channel NewsAsia that it was looking into the matter. The company also highlighted its support page for customers to report any problems with purchases made on iTunes.

United Overseas Bank (UOB) told Channel NewsAsia on Sunday that it increased its monitoring of iTunes transactions in the previous week.

“Where our system detected a potentially fraudulent transaction, we immediately called our customer to check with them on the transaction,” said UOB, adding that it would help a customer claim a refund once the fraudulent transaction is confirmed. A new card would also be issued as an additional security measure, UOB said.

At OCBC alone, there were 58 cases of fraudulent transactions in July.

“In early July, we detected and investigated unusual transactions on 58 cardholders’ accounts. Upon confirmation that these were fraudulent transactions, we deployed the necessary counter-measures and are currently assisting the affected cardholders via the chargeback process,” said Mr Vincent Tan, head of credit cards at OCBC Bank.

DBS customers who report unauthorised iTunes transactions would receive a temporary credit while the bank investigates the charge dispute, the bank told Channel NewsAsia.

“Banking security is of foremost concern to us and we use industry-leading security technology and protocols to ensure that our customers’ information and money are safe,” said a DBS spokesperson. “We also constantly monitor credit/debit card transactions in real time for any suspicious activities.”

Channel NewsAsia has reached out to HSBC and Standard Chartered for comment.

FRAUDULENT iTUNES CHARGES WORTH MORE THAN S$1,000

Since Channel NewsAsia’s first report on the fraudulent iTunes charges on Sunday, more have taken to social media to share their plight, with some even hit by transactions amounting to around S$7,000.

One of the victims, who preferred to remain anonymous, told Channel NewsAsia that more than S$7,000 worth of iTunes transactions were charged to her HSBC credit card.

She discovered the transactions on the previous day after receiving an SMS notification from the bank informing her that her credit card limit was left with “less than 30 per cent”.

“I don’t have any records of those unauthorised transactions as they (had) told me over the phone. I will see it when my statement comes next month,” she said.

She added that she was referred to a senior adviser when she contacted Apple, who “repeatedly” told her that the company was unable to refund the disputed amount.

“This is a case of credit card fraud, which is not due to Apple and/or iTunes at all,” she said, citing the Apple staff.

She was also told that her credit card may have been used for online purchases other than Apple, resulting in the fraudulent transactions, said the victim. She uses her card for purchases on Apple’s App Store, she said.

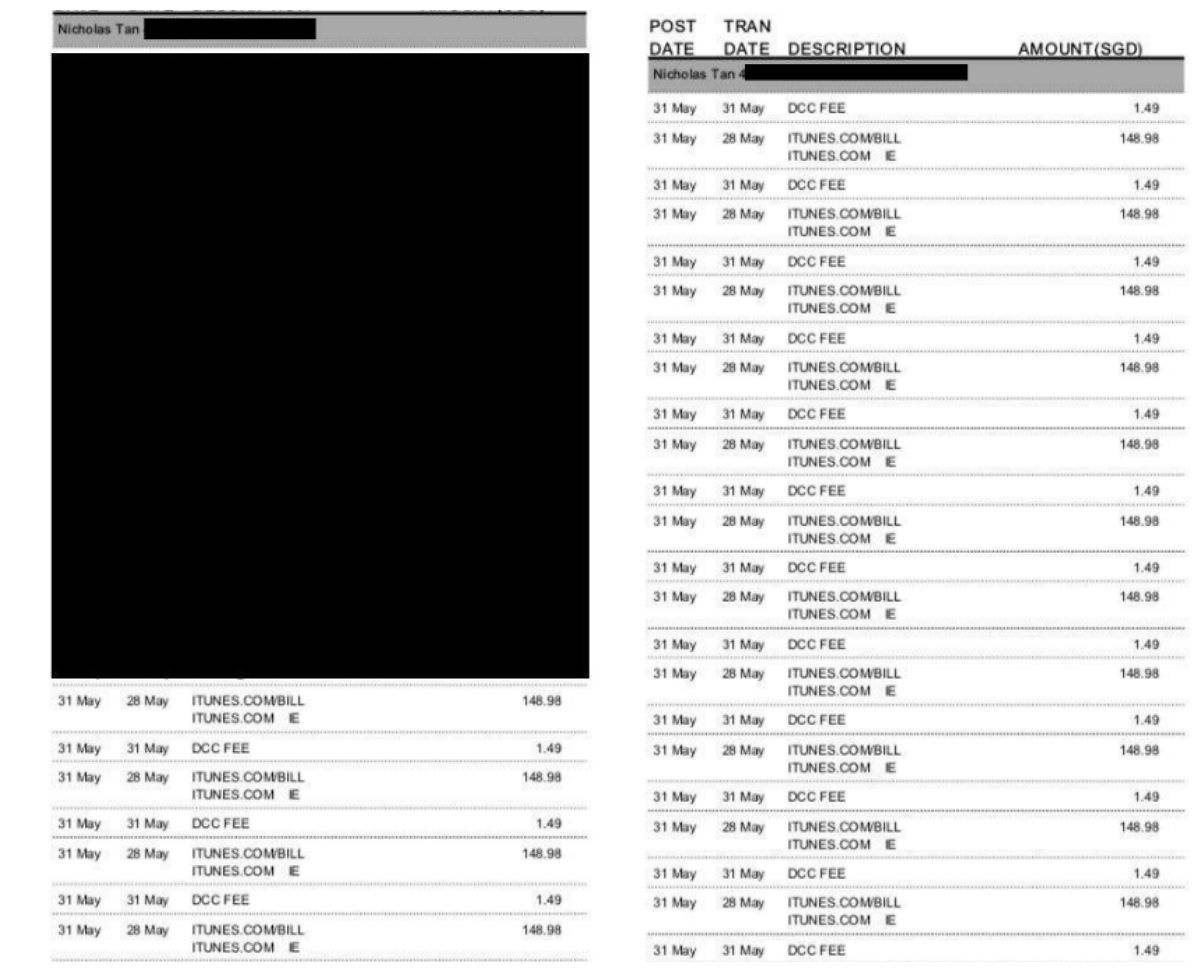

Sales manager Nicholas Tan, 31, was charged more than S$2,000 to his HSBC credit card in May. Each of the fraudulent iTunes transactions costs S$148.98, he said.

“The bank called me to verify if I had made those transactions. I was not even in Singapore,” Mr Tan said. “HSBC was fast. They noticed those transactions and called me immediately. I missed their first call but they called me the next day to follow up,” said Mr Tan.

A screenshot of iTunes charges in Mr Nicholas Tan’s HSBC credit card statement. (Image: Nicholas Tan)

Another victim, Mr Wilson Wong, 26, is currently waiting for refunds worth nearly S$2,000 after a total of 12 fraudulent iTunes transactions were charged to his OCBC debit card on Jul 13.

“Just disappointed with OCBC. They only called me when the transaction was at S$1,900,” said the singer-songwriter, who wished the bank had alerted him earlier instead of four days later, on Jul 17.

Architectural designer Hariz Lim recently received refunds worth more than S$1,700 after 11 iTunes transactions were made through his OCBC debit account on Jul 16. Each of the transactions costs S$158.98.

“The shocking thing is, I don’t even have any credit or debit card details saved on my own iTunes account,” said Mr Lim. “Apple/iTunes was not even aware of the fraudulent transactions (in my account) until I informed them.”