SINGAPORE: Landlords will now be required to step up and provide their struggling small and medium-sized enterprise (SME) tenants with rental waivers of up to two months after Parliament passed amendments to the COVID-19 regulations on Friday (Jun 5).

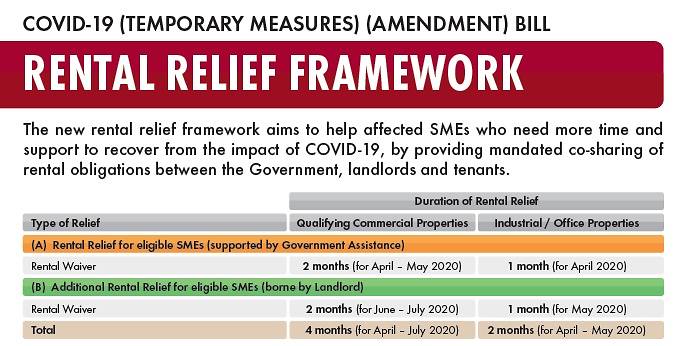

As part of the changes that will be implemented at the end of next month, commercial property owners must give eligible tenants a waiver of base rent for June and July. Those that own industrial and office properties will have to waive the base rent for the month of May.

These rental waivers to be borne by landlords will come on top of already-announced rent support from the Government, which landlords are required to pass on as rent waivers for the months that the “circuit breaker” was in place.

Taken together, tenants at commercial properties are set to get four months’ worth of rental relief from April to July, while those renting spaces at industrial or office properties will get two months of help for April and May.

READ: Landlords to give SME tenants more rental relief under proposed amendments to COVID-19 laws

To be eligible, SMEs need to have no more than S$100 million turnover in 2019 and suffered at least 35 per cent drop in average monthly revenue from April to May compared to the same period last year. They also must have tenancies entered into before Mar 25 this year.

Sub-tenants or licensees that meet these requirements will also be eligible for the rental reliefs.

(Infographic: Ministry of Law)

“FAIR SHARING OF OBLIGATIONS”

The wide-ranging COVID-19 (Temporary Measures) Act, which was passed in Parliament on Apr 7 and took effect on Apr 20, grants those who cannot fulfil contractual obligations amid the virus outbreak with temporary relief for six months.

That was a “major intervention”, said Law and Home Affairs Minister K Shanmugam as he tabled the amendment Bill on Friday.

But since then, the economy has taken another turn for the worse and uncertainties remain as Singapore takes a phased re-opening of its economy. For some businesses, this means they would not be able to reopen until the second phase and even then only partially.

There has also been feedback on “uneven” concessions from landlords and how accumulated arrears need to be “handled fairly”, said Mr Shanmugam.

READ: Singapore’s GDP expected to shrink between 4% and 7% as 2020 growth forecast cut again on COVID-19 impact

With that, the Government has decided to intervene in “a more substantive way”, said the minister, noting similar interventions in countries like Australia and Germany.

The amendment Bill, added Mr Shanmugam, is premised on a “fair sharing of obligations” between the Government, landlords and tenants.

The Government has since rolled out relief measures across four Budgets, while the various criteria for SME tenants mean that only those who have taken a “substantial hit … will get more help”.

The minister also noted it is “not realistic” to expect market forces to arrive at a “fair” burden sharing between landlords and tenants, and the risk of non-intervention could mean impact for everyone.

Last year, SMEs contributed to 45 per cent of economic growth and 72 per cent of employment in Singapore, the minister explained. The failure of SMEs will have a domino effect on the rest of the economy and for landlords, an economic downturn would weigh on the value of their assets.

“Everyone has a stake in the success of the SMEs,” he said.

HELP SMALLER LANDLORDS: MPs

The Bill received support from the three Members of Parliament (MPs) who spoke during the debate.

East Coast GRC MP Jessica Tan said the amendments take a “targeted approach” and are “reasonable” as they do not apply across the board to all SMEs and businesses.

While small businesses are the immediate beneficiaries of the Bill, Bukit Batok MP Murali Pillai said landlords are protected in the long run as it ensures that the tenant’s market will not collapse.

He added: “This should not be seen as an anti-landlord Bill.”

However, the MPs highlighted some concerns, particularly how the rental waivers required of landlords could put some of them into financial hardship.

This includes smaller landlords that are dependent on the rental income to meet their financial obligations, said Ms Tan.

Holland-Bukit Timah GRC MP Christopher de Souza said a “flexible system” is needed to differentiate between landlords that are large corporates and those who have invested in small commercial shophouses as a form of retirement income.

He cited the predicament of one of his residents who relies on rental income to service bank loans and the rest for living expenses. In a letter to Mr de Souza, the resident had said that having to “further absorb an additional two months of rent would be too much for many to bear” amid problems with rent collection, as well as demands for waivers and haircuts from tenants.

READ: Businesses call for fair tenancy law to solve ‘growing’ imbalance in landlord-tenant relationship amid COVID-19 outbreak

Mr Shanmugam said this has been considered carefully and under the amendments, landlords that are unable to provide tenants with the additional rental waivers may seek an assessment on “grounds of financial hardship”. If the appeal is granted, they will only have to give half of the waivers.

The factors considered during the assessment include the annual value of the property and whether rental forms a substantial proportion of the landlord’s total income.

“This will help us distinguish between larger landlords and those that depend on rental for their livelihoods,” the minister said.

Authorities also announced more support for cash-strapped landlords earlier this week, such as allowing landlords who are individuals and are current in their loan repayments as at February this year to defer principal and interest repayments up to Dec 31.

Larger corporate landlords, including real estate investment trusts (REITs) listed on the Singapore Exchange, are encouraged to explore funding solutions with their banks, authorities have said. S-REITs are also given more time to distribute their taxable income derived in FY2020 and FY2021 to qualify for tax transparency treatment.

S-REITs have raised various concerns such as potential constraints on their operating income and cash flow, said Mr Shanmugam. These measures will give them more flexibility in managing cash flows and prevent them from incurring additional tax expenses, he added.

HELP WITH ARREARS AND MORE

Other amendments to the COVID-19 regulations include allowing eligible SMEs to repay part of the rental arrears that they may have accumulated from Feb 1 up till Oct 19 this year via instalments, with the first being no later than Nov 1.

For commercial tenants, the maximum amount of arrears that can be paid in instalments will be five months of base rent. For those at industrial and office properties, it will be four months of base rent.

The interest payable on such arrears will be capped at 3 per cent per annum. If a tenant fails to make payment or terminates the lease, the repayment scheme will be cancelled and it may be liable to repay all arrears immediately.

In response to Mr Murali’s question on how the 3 per cent interest rate is derived, Mr Shanmugam said it is “comparable” to the median rate of secured bank loans in April, while considering the landlords’ cost of capital with property as security.

“We are aware that some landlords’ cost of capital could be higher than 3 per cent but this rate is intended to strike a balance between the needs of landlords who have their own financial obligations and their tenants who do face significant challenges repaying their rental obligations under these fairly extraordinary circumstances,” the minister said.

Apart from that, the Bill also introduced a cap on late payment interest for arrears that arise due to COVID-19 under specific contracts, as well as provide relief for tenants who are unable to vacate their non-residential premises at the end of their leases due to COVID-19.

On the latter, Mr Shanmugam said the ministry has received feedback from some tenants whose tenancies expired during the circuit breaker period and were not able to find movers or enter the premises.

“In such cases, it would be unfair for the tenant to have to pay double rent or similar charges under the contract of the law,” he said, although he said there could be situations where it “might be fair for the tenant to pay some amount”.

“(This) especially if the tenant continued to derive benefit from the premises. We will prescribe the circumstances and how that amount can be assessed,” said the minister.

While Mr Murali supported this amendment, he asked if there is a corollary provision to protect landlords who may have a back-to-back arrangement with new tenants.

Mr Shanmugam said such knock-on impact will be taken into account, noting that a landlord can serve a notification for relief on the new tenant in such instances.

“This will give the landlord and new tenant time to work out a compromise. If they cannot agree, they can apply to an assessor who will make a determination to reach a just and equitable outcome.”

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the coronavirus outbreak: https://cna.asia/telegram