SINGAPORE: Chinese e-commerce giant Alibaba Group has agreed to buy a 50 per cent stake in AXA Tower in a deal that values the property at S$1.68 billion, a boost of confidence to the Singapore market amid a downturn caused by the COVID-19 coronavirus pandemic.

A share purchase agreement was made between a consortium of investors led by Perennial Real Estate Holdings to sell the stake to the Singapore arm of Alibaba, said Perennial in a statement on Wednesday (May 6).

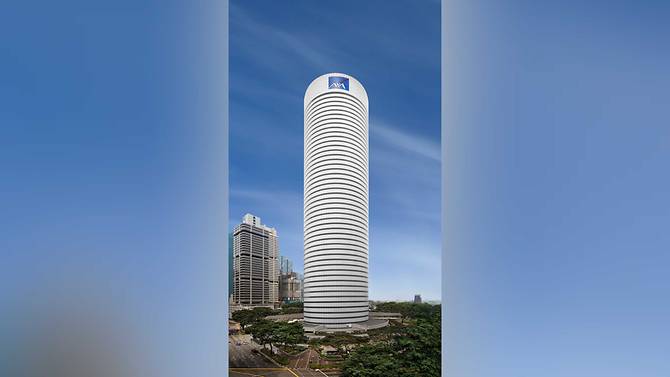

AXA Tower, located 8 Shenton Way in the Central Business District, is a 50-storey grade-A office development with a retail podium, according to Perennial.

It has an existing gross floor area of 1.05 million sq ft, and has secured regulatory approval from the Urban Renewal Authority to further increase its floor area to 1.55 million sq ft to integrate hotel and residential usage under the CBD Incentive Scheme.

AXA Tower at 8 Shenton Way. (Photo: Perennial Real Estate Holdings)

The deal is expected to be completed in June, after which Alibaba Singapore and Perennial Newco, a newly formed unit of the consortium, will form a joint venture to redevelop the building.

“Alibaba is already an anchor tenant at AXA Tower, and we are pleased to have their support in creating an iconic landmark in Singapore’s CBD,” said Perennial CEO Pua Seck Guan.

READ: Singapore’s factory activity shrinks to lowest reading since November 2008 amid COVID-19 outbreak

READ: COVID-19: Temporary relief measures for property developers affected by disruptions

The COVID-19 coronavirus pandemic has cast a dark cloud on the Singapore economy, as businesses announce wage cuts or urge employees to go on no-pay leave in the face of declining revenue. The Singapore central bank last month announced that the country will enter a recession.

Wednesday’s announcement will provide a confidence boost to the Singapore market and reaffirm investor appetite for CBD assets, said JLL, a real estate management firm engaged by Alibaba Singapore for the AXA Tower deal.

“Amid ongoing market uncertainty related to the COVID-19 pandemic, technology and e-commerce companies have become essential providers of goods and services across the region,” said Ms Regina Lim, head of Asia Pacific capital markets research at JLL.

“As a result of increased demand for their services and strong capital positions, they have remained active in their expansion and investment plans, with global gateway cities like Singapore proving an attractive destination for deployment.”