SINGAPORE: Scammers have been sending fake emails with the name and logo of the Monetary Authority of Singapore (MAS), the authority said on Friday (May 15), cheating nine victims out of more than S$50,000 since last month.

MAS’s statement comes after the Singapore Police Force (SPF) on Friday issued an advisory about bogus websites impersonating licensed moneylenders.

The police reported that it was investigating seven people for their suspected involvement in a case of loan scam, after their bank accounts were used to receive money from a victim.

Initial investigations showed that the victim had visited a bogus moneylender’s website and was scammed into making numerous payments in order for his loan application to be approved.

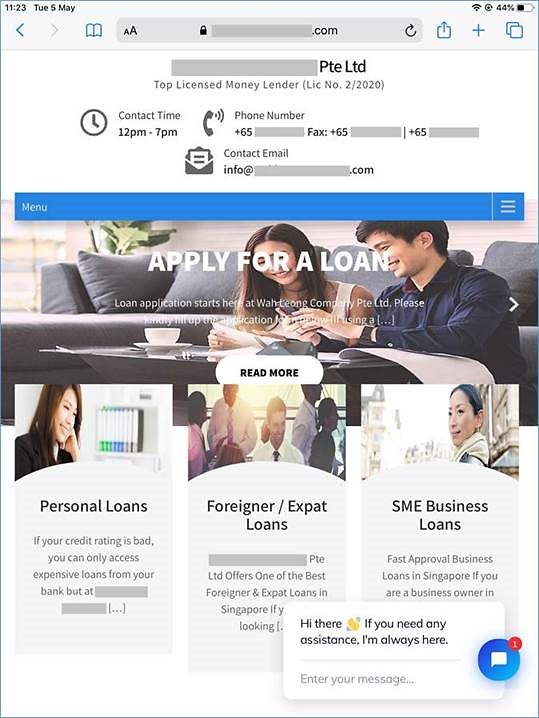

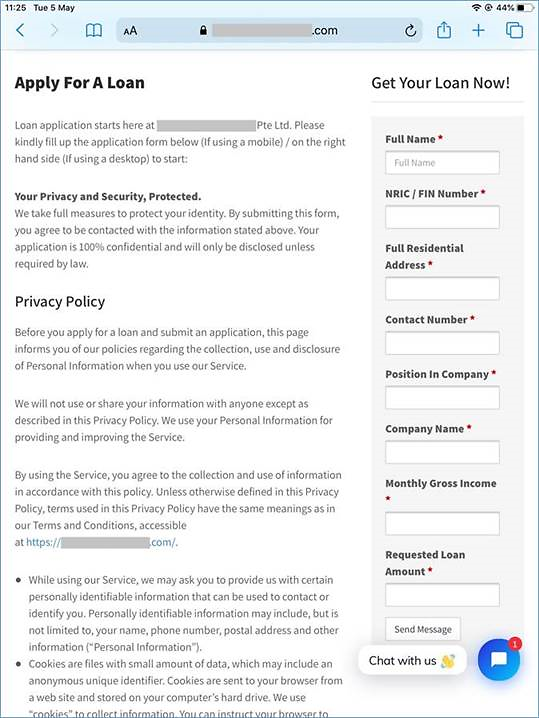

A screengrab of a bogus website impersonating a licensed moneylender. (Photo: Singapore Police Force)

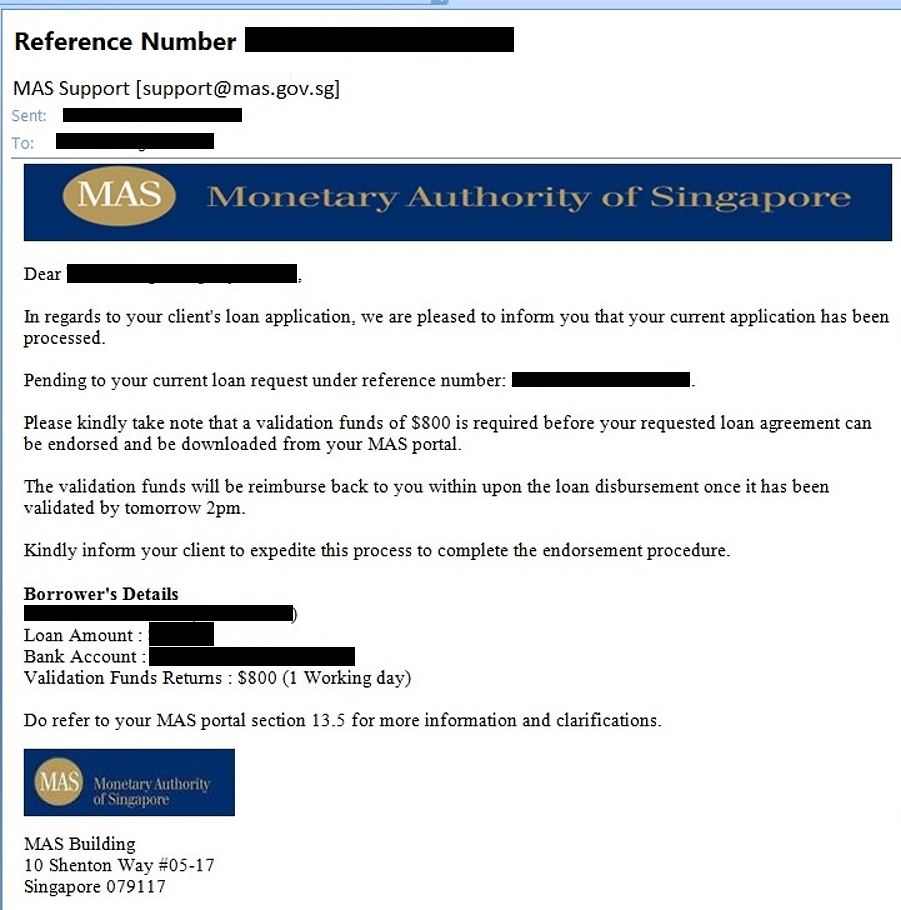

“The Monetary Authority of Singapore has also received reports that fake emails misusing the MAS name and logo were used to perpetuate some of these scams,” said an MAS spokesperson.

“These scam emails may ask loan applicants to pay ‘validation fees’ before the requested loan agreements can be endorsed and downloaded from an ‘MAS portal’.”

A screenshot of a scam email using MAS’ name and logo. (Photo: Monetary Authority of Singapore)

MAS said 16 people have reported receiving the fake MAS emails since April, with nine of them being scammed into making payments totalling more than S$50,000.

“MAS does not handle any loan applications nor require any validation fees,” it said. “MAS also does not collect fees of any nature from members of the public. Individuals are advised to be wary of emails that involve fund transfers to third parties.”

The police warned that bogus moneylending websites would solicit victims’ personal information such as their NRIC number, address and contact number, which can then be used by loansharks and scammers to harass or further scam their victims.

A screengrab of a bogus website impersonating a licensed moneylender. (Photo: Singapore Police Force)

Licensed moneylenders are not allowed to make cold calls or send unsolicited text messages, said the police.

Licensed moneylenders are required to meet loan applicants in person at an approved place of business before granting a loan. They will not ask applicants to make any payment, such as GST, admin fee or processing fee, before disbursing the loan.

Any administrative fee a licensed moneylender charges will be made after the loan is granted, and is usually deducted from the loan principal.