SINGAPORE – The gap between the wealthy and the poor is widening, and in countries like Singapore it is more and more being recognised as a cause for concern.

Wealth inequality in developed countries has risen to a 30-year high, according to a 2015 report by the Organisation for Economic Cooperation and Development (OECD).

Wealth deals with the value of a person’s entire assets, such as disposable cash and property, minus all their debts, such as loans and mortgages. Income, or their earnings from work, are added to their pile of wealth.

The National University of Singapore’s (NUS) Vice-Dean of Research Sumit Agarwal believes that wealth inequality is a more important measure than income inequality. “As wealth inequality increases, it will create tensions and it will create problems in society,” he said.

Channel NewsAsia documentary It Figures brings you the eight key things you should know about Singapore’s wealth gap. (Watch the episode here.)

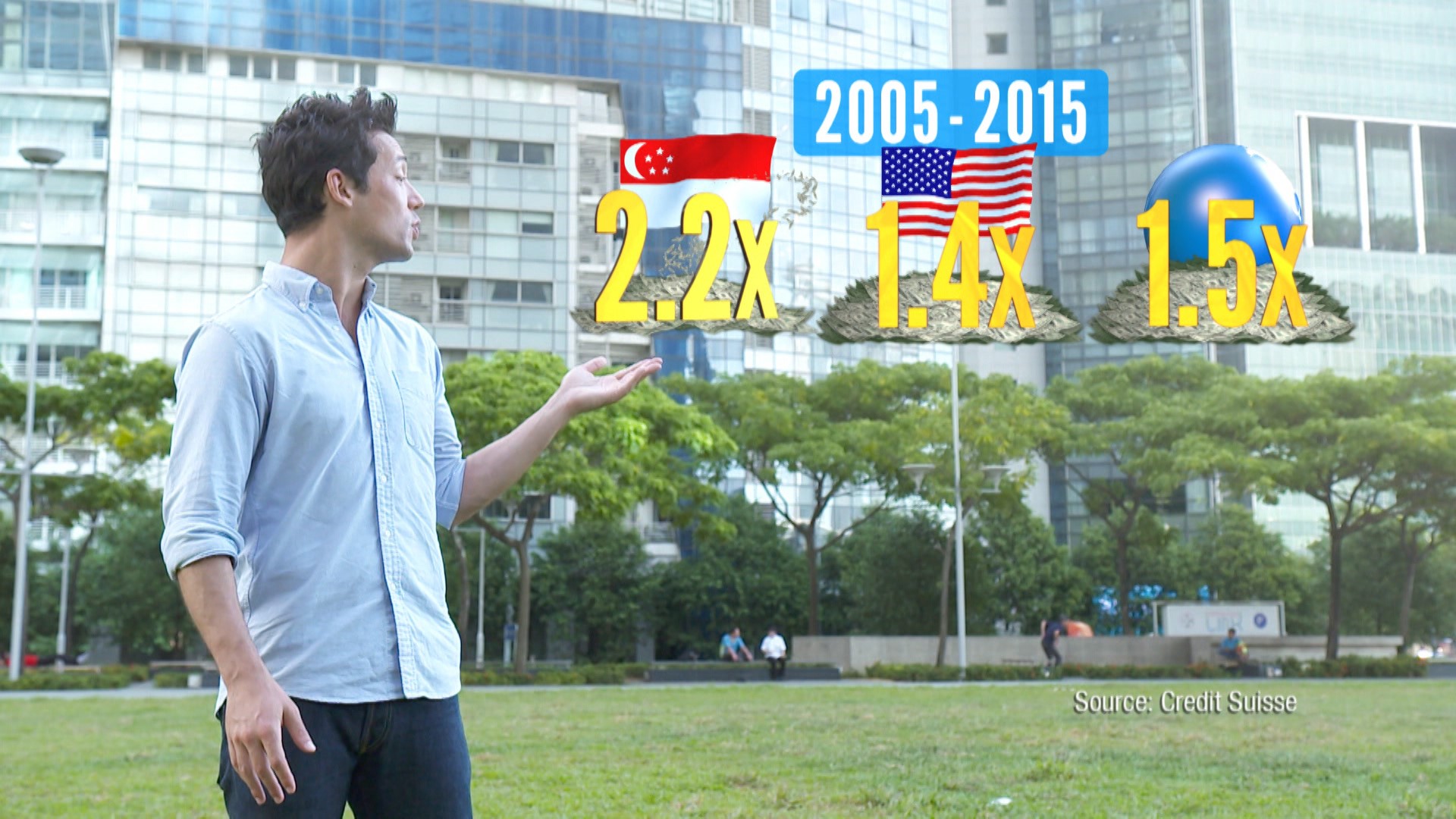

1. Household net wealth in Singapore more than doubled between 2005 and 2015.

Singapore’s household net wealth was S$700 billion in 2005, and it grew to more than S$1,500 billion in 2015, according to the Household Sector Balance Sheet.

According to SingStat, the Household Sector Balance Sheets looks at the assets and liabilities of all households in Singapore. However, it does not include foreign assets such as property owned by Singaporean residents.

Compared to the rest of the world, Singapore’s wealth grew much faster. In the last 10 years, according to Credit Suisse, Singapore’s wealth increased by 2.2 times, while the US’s wealth grew by 1.4 times, after accounting for inflation.

Singapore is one out of fewer than 20 countries in the world that makes its wealth information public.

2. The housing boom is one of the main reasons for Singapore’s wealth growing quickly.

Singapore’s fast-growing wealth is partly a result of its housing boom, which led to an increase in value of Singaporean residents’ property, Ms Selena Ling, head of OCBC’s Treasury Research and Strategy, told It Figures. “As the housing prices rise, you see asset wealth moving up in tandem.”

According to Professor Sumit, it is also because of Singapore’s low taxes and relative stability in the region. This has enticed foreign investors to safeguard their wealth in Singapore by buying up property here or depositing it in local banks.

3. Overall average wealth is more than double of what’s owned by the person in the middle, if Singaporeans were lined up in order of wealth.

If wealth were equally distributed between the wealthiest and least wealthy in a country, the median wealth to average wealth would be in a ratio of 1 is to 1, according to NUS Department of Economics lecturer Ong Ee Cheng.

Median wealth refers to the wealth owned by the person in the middle when we line up all residents above the age of 20 according to their wealth, from least to most wealthy.

The ratio of median to mean (average) wealth, or the wealth gap ratio, is a measurement used by the OECD to represent wealth inequality.

“If you had a very few people who are very rich, they would be pulling up the mean,” said Dr Ong.

In 2015, Singapore’s mean wealth was S$380,000 and its median wealth was S$140,000, according to global financial company Credit Suisse’s estimates.

That would make Singapore’s wealth gap ratio 1 is to 2.72.

4. Singapore’s wealth gap is narrower than that of the United States, Sweden and Switzerland.

Singapore’s wealth gap is relatively narrow compared to other advanced economies.

According to Credit Suisse’s 2015 report, the US, which is the world’s wealthiest country, has a wealth gap of 1 is to 7.09. Scandinavian countries such as Sweden and Denmark have ratios of 5.42x and 4.85x respectively.

Countries with wealth gaps narrower than Singapore’s include Australia and Japan, whose ratios are around 1 is to 2.

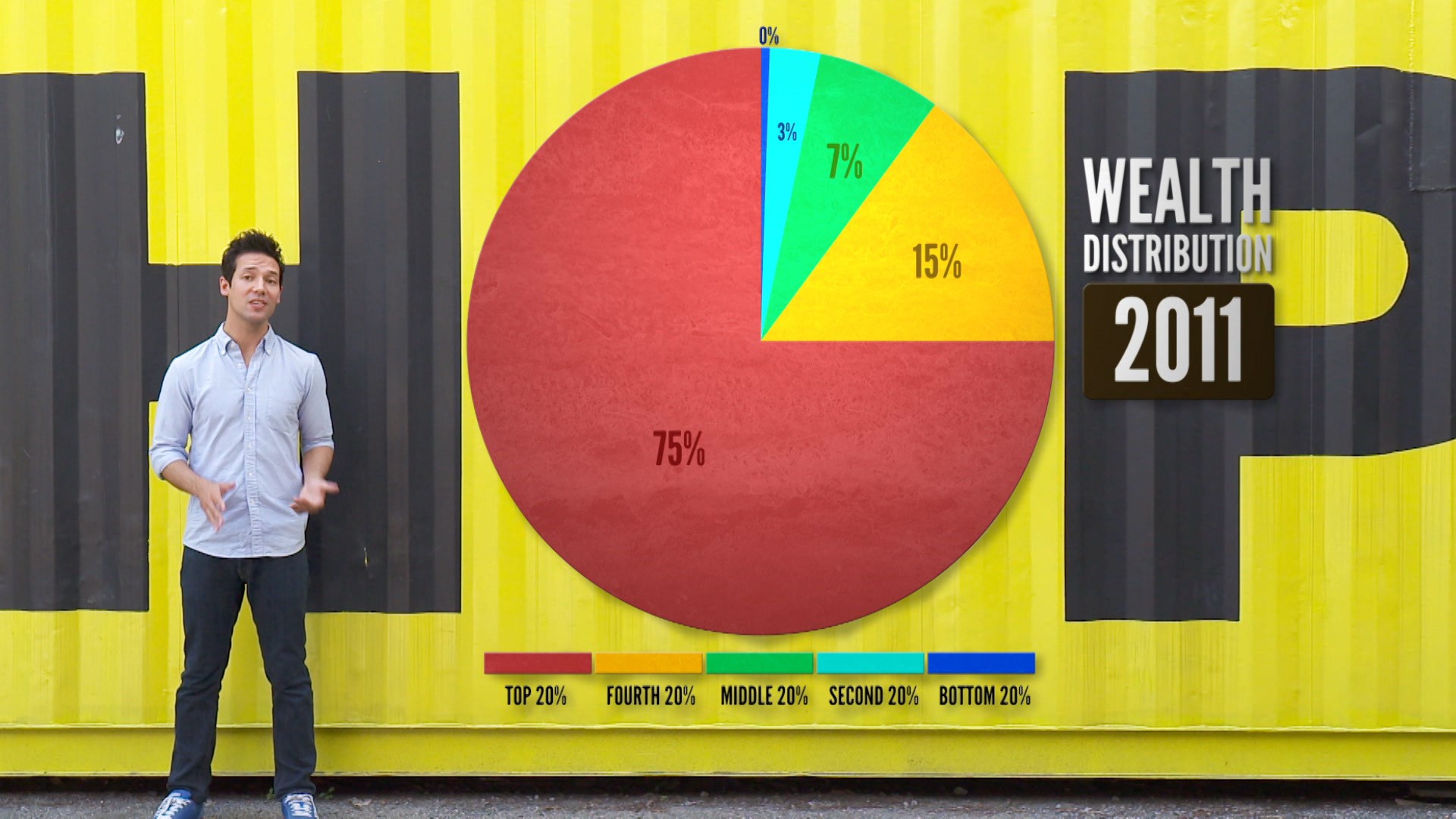

5. 73 per cent of Singapore’s wealth is owned by the wealthiest 20 per cent.

This is based on an estimate of Singapore’s wealth distribution by Credit Suisse, as there is no official statistics on how wealth is distributed here. The bottom 20 per cent owns 1 per cent of the overall wealth.

But the wealthiest 20 per cent are not homogeneously wealthy. Dr Ong pointed out that looking at 20 per cent of people at a time is a broad measure.

“For example, within the top 20 per cent, you have the one-percenters who are multibillionaires and fly around on private jets, “ she said. “And you have people like you and me who are earning a decent living but we’re still taking out mortgages for our homes.”

6. Singapore’s wealth distribution has not changed much in the last 5 years.

From 2011 to 2015, the percentage of wealth owned by each 20 per cent segment of Singapore’s households has remained almost constant, according to Credit Suisse’s estimates.

7. But despite this, wealth inequality is rising in Singapore.

Singapore’s wealth distribution remaining constant might not necessarily be a good thing. Considering that Singapore’s wealth has more than doubled in the last 10 years, this means that the wealth owned by the top 20 per cent would be growing more rapidly than the bottom 20 per cent’s.

“It is very likely…that the top 1 per cent [of households’] share increased from 20 per cent to 30 per cent. So if you slice it up by that, you’ll probably see inequality increasing,” said Dr Ong.

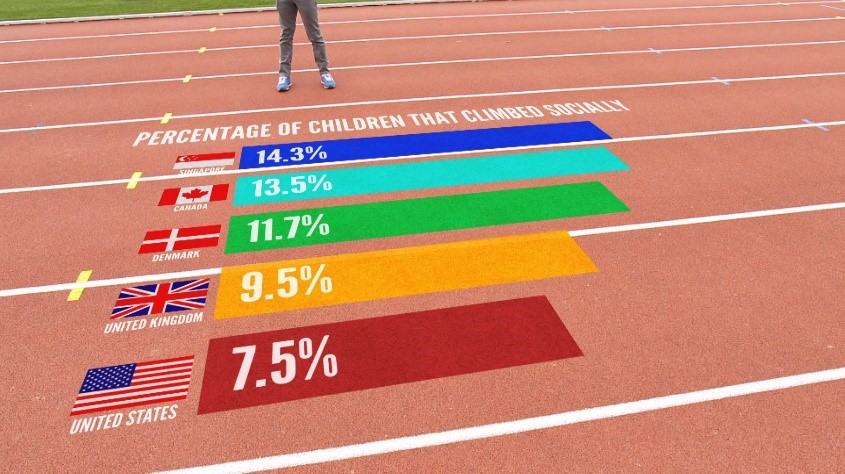

8. The good news is, social mobility in Singapore is high.

In fact, it’s one of the highest in the world.

Among young adults, 14 per cent of those from the poorest 10 per cent of households moved into the top 20 per cent of income earners, according to Deputy Prime Minister and then-Finance Minister Tharman Shanmugaratnam at the 2015 Budget debate.

In contrast, only 7.5 per cent in the US and 8 per cent in the UK did so.

New episodes of It Figures every Monday at 8pm SG/HK on Channel NewsAsia. Watch the full episode on the wealth gap on Toggle.