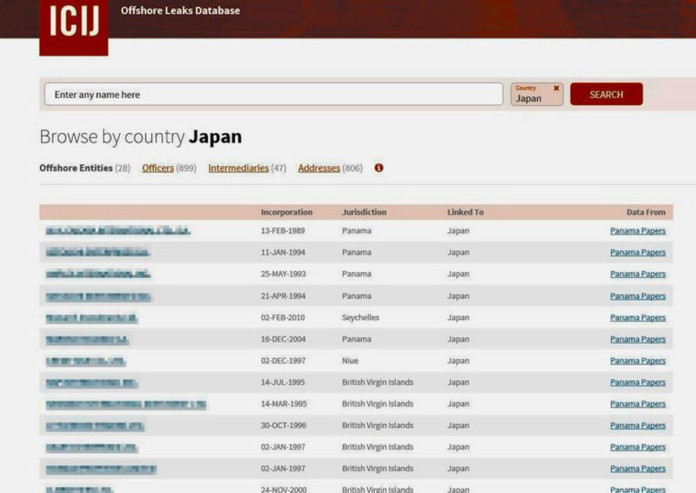

The Panama Papers database that was made available on the website of the International Consortium of Investigative Journalists on Tuesday Japan time contains about 400 cases categorized as relating to Japan. The database lists about 230 individual names believed to be Japanese and about 20 Japanese companies.

Members of notable Japanese companies interviewed by The Yomiuri Shimbun uniformly expressed confusion, saying things such as, “We have no idea why our names were made public, because we didn’t evade tax.”

However, cases of tax evasion and asset concealment through the misuse of tax havens have been reported in the past.

Experts are calling for the latest cases to be thoroughly clarified by tax authorities.

‘Surprising’ announcement

“We use tax havens so we can facilitate procedures for establishing companies and speed up transactions.

The use [of tax havens] isn’t aimed at tax evasion or reduction,” said a spokesperson of a leading trading company based in Minato Ward, Tokyo.

The company, which founded affiliates in the British Virgin Islands, alleges that it makes tax payments appropriately based on legislation against tax havens and discloses in its financial reports that it takes such actions.

“We could lose social credibility if we’re deemed dishonest simply for being listed in the Panama Papers. It’s extremely upsetting,” the spokesperson said.

Another leading trading firm based in Chiyoda Ward, Tokyo, invested in companies founded overseas, including in Hong Kong.

“We aren’t benefiting from low tax rates. Doing such suspicious things would bring a greater risk if it was found out later and then became problematic,” the firm’s spokesperson said.

The company received a flood of inquiries, mainly from clients, after its name was disclosed in the papers.

“We have the problem of being mentioned in online message boards where there are assumptions that we’re avoiding tax payments,” the spokesperson said.

Money lost

The names of business entrepreneurs are also listed in the papers as stockholders of companies that exist in tax havens.

In 1996, a manager of a leading online shopping company invested ¥800,000(S$10,031) in a company in the Virgin Islands after being approached by a foreigner that an acquaintance introduced to him.

His company’s spokesperson told The Yomiuri Shimbun: “Our manager seems to remember only making a loss.”

About four years ago, a male professor at a private dental university in the Hokuriku region jointly established a company in the Virgin Islands with a Chinese financier who invested money for developing anticancer drugs.

Right after the company was established, however, the professor lost contact with the Chinese financier.

The company was since neglected and has conducted no transactions.

“I have no intention at all of making money [from using tax havens]. All I wanted was to do my research,” the professor said.

Tip of the iceberg?

“It’s unlikely that all the transactions conducted through the use of tax havens are clean,” said Go Kawada, a certified tax accountant and former Sendai Regional Taxation Bureau chief who is an expert on international taxation.

Wrongdoing via tax havens remains rife in Japan. One such case is the massive cover-up of losses by Olympus Corp. that was exposed in 2011.

Three former securities firm employees who helped Olympus hide its losses were found to have kept about ¥2.2 billion in remuneration from Olympus in the bank accounts of paper companies established in tax havens including Liechtenstein.

“Tax havens can be misused not only for out-and-out crimes, but also for tax evasion by exploiting gaps in tax rates, and for asset concealment using the nature of confidentiality of personal information,” Kawada stressed.

Aside from the law firm that became the source of the recent Panama Papers leak, Kawada said there are many brokers who arrange transactions using tax havens.

“The latest disclosure is just the tip of the iceberg,” he said.

Tax authorities in Japan are paying attention to the Panama Papers. The National Tax Agency announced Tuesday that it will try to gather information at every possible opportunity and conduct tax inspections whenever problematic transactions are confirmed, with the aim of realizing adequate and fair taxation.

Japan’s tax authorities are expected to exchange information about the companies and individuals listed in the Panama Papers with their overseas counterparts, according to sources.

They will collate information from the Panama Papers and information declared to them, and conduct inspections if there are problems.