They sank their savings into undeveloped land in India, drawn by visions of gleaming villas, upcoming infrastructure and returns of more than 100 per cent. That was between 2007 and 2011.

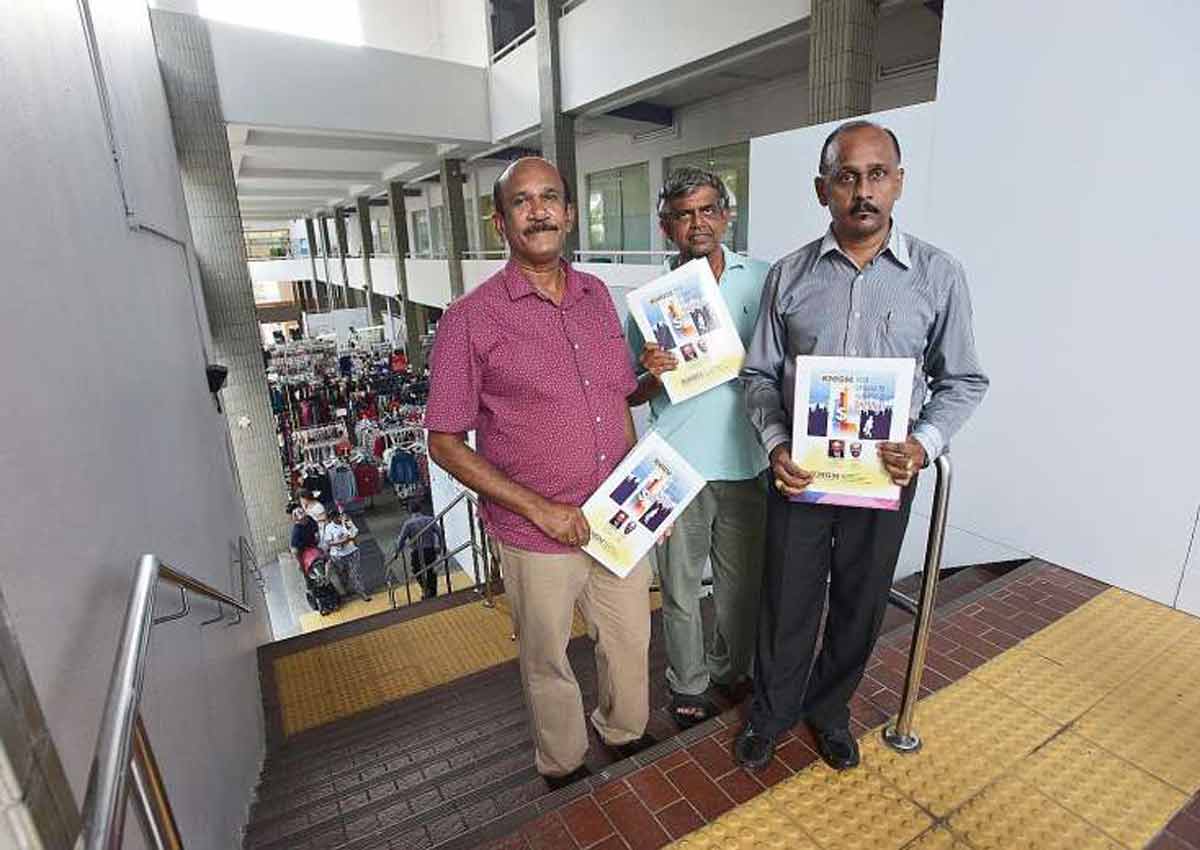

Now, the 33 Singaporean investors – who spent more than $780,000 – own land of questionable value, which is hard to sell.

They are crying foul at Singapore-registered KMGM International which sold them the land.

They claim it has not been developed and has hardly risen in value. They want to sell it back.

About 20 of them staged a walk-in on May 5 to confront KMGM director S. Gulam at the firm’s Bukit Merah premises, demanding assurances that they could sell back their land.

He was not there, but assured them by telephone that he would meet them on May 16 .

But on May 13 they received letters saying that the matter would be handled through his lawyers at Advaitha Law Corporation.

Advaitha director G.B. Vasudeven told The Sunday Times that his client was ready to obtain valuations for each of the investors’ land parcels, but declined to disclose any further course of action.

He added that he has written to the 33 to say that if they try to enter KMGM’s offices again, they will be reported to the police as trespassers.

Twenty investors have since gone on to make police reports against KMGM.

The group of 33 had bought 45 plots of land, each a few thousand sq ft in size, in Chennai .

They are mostly in their 50s and 60s, and they said they trusted KMGM because it is a Singaporean firm and its directors, lawyer R. Kalamohan and Mr Gulam, a former journalist, are well-regarded members of the Indian community.

Retired navy officer Anandam Thomas, 62, bought two plots of land for about $41,470 in 2008.

“My father was from India, and I wanted a little piece of India for myself,” he said.

After payment, he and the other buyers were flown to Chennai to see the land and receive their sale deeds.

Last year and in April this year, he went back on his own to check and found the land was still undeveloped and occupied by squatters.

He said that after his attempts to sell the land back to KMGM failed, he decided to gather fellow investors in the same situation.

Mr Gulam, 54, told The Sunday Times by telephone that he was not out to cheat anyone and meant to help the investors sell the land.

However, he said it was impossible to sell it at a profit right now because the Indian rupee had fallen drastically in the last few years and the property market was in a slump.

He said: “When you invest overseas, you must take a risk.

“If you buy a house now and the price goes down, can you tell the developer you want your money back?”

Mr Kalamohan, 68, who left KMGM in 2014, said: “There was nothing more to sell and I was of no use to the company, so I thought it was time to leave.”

He added that there was nothing wrong with the investors’ documents, which he had examined, and all the purchases were valid.

Of the 45 contracts among the group, 24 had a clause guaranteeing they could sell the land back to the company after three years “at the best prevailing market price”.

However 27 contracts lacked a “patta”, an Indian land ownership document.

New Delhi-based lawyer Alok Tewari, a senior partner with Indian law firm Kochhar & Co, said: “Legally it may be possible to sell the property without a patta.”

He added, however, that sometimes the authorities may demand to see a patta to register a sale deed.

Property experts said overseas landbanking is fraught with risk.

Mr Alan Cheong, Singapore research head for real estate firm Savills, advised investors to check whether the country’s legal framework is solid and can be enforced even by an overseas national, as well as the reputation of the property agency marketing the product.

Retired civil servant Manokaran Ramasamy, 64, and his late wife spent $129,510 on four plots of land in 2008.

His wife died from cancer in March. He said all he wanted was some form of closure from KMGM.

“Even in the pain of her last days, she would go back to them to ask about selling the land. I don’t understand why they didn’t entertain her,” he said.

“I don’t think they can honour the agreement. They owe it to us to fill in the blanks.”

This article was first published on June 12, 2016.

Get a copy of The Straits Times or go to straitstimes.com for more stories.