SINGAPORE: With the COVID-19 outbreak coming at a time of an uncertain economic outlook, 2020 has already seen its fair share of challenges – and it is only the second month of the year.

As Singapore ushers in a new decade marked by “major uncertainties”, Finance Minister Heng Swee Keat introduced a Budget aimed at helping local households, workers and businesses weather these challenges.

What do the measures announced on Tuesday (Feb 18) mean for Singaporeans and Singapore businesses?

Here’s a quick recap:

1. WE’RE EXPECTING A PRETTY LARGE OVERALL DEFICIT

First, the basics. Singapore is planning for a “more expansionary” Budget to boost the economy, with an overall deficit for FY2020 expected – the Government expects the overall budget balance to be a deficit of S$10.9 billion (or 2.1 per cent of GDP).

The Singapore economy faces “considerable uncertainty” in the coming years, said Mr Heng, citing heightened risks to the global economy and the rapidly evolving COVID-19 outbreak as examples.

On Monday, the Ministry of Trade and Industry downgraded its gross domestic product (GDP) forecast amid concerns about the ongoing COVID-19 outbreak.

2. THERE’LL BE MORE MONEY TO FIGHT THE COVID-19 OUTBREAK

As anticipated, the novel coronavirus outbreak was front and centre of the Finance Minister’s Budget speech. The outbreak will “certainly” impact our economy, said Mr Heng, affecting industries and disrupting supply chains.

As such, an additional S$800 million will be set aside in this Budget to support the frontline agencies fighting to tackle the outbreak.

BOOKMARK THIS: Our comprehensive coverage of COVID-19 and its developments

Help will also be given to specific sectors especially impacted by the disease, such as aviation, retail, food services and point-to-point transport services.

3. HELP FOR LOCAL WORKERS TO KEEP THEIR JOBS

Given all these uncertainties, a special S$4 billion package was announced to help local workers stay employed and to support enterprises.

As part of this Stabilisation and Support Package, a temporary Jobs Support Scheme will be introduced to help firms retain local workers. Essentially this comes in the form of offset wages – for Singapore Citizen or Permanent Residents in employment, the authorities will offset 8 per cent of their wages, up to a monthly cap of S$3,600, for three months.

READ: Budget 2020: S$4 billion support package for workers, firms amid COVID-19 outbreak

About 1.9 million local employees stand to benefit from this.

Companies will also get help with cash flow, in the form of a corporate income tax rebate as well as various enhancements for tax treatments under the corporate tax system.

4. GST INCREASE GETS PUSHED BACK

Remember that planned GST hike announced two years ago? It’s been pushed back, in consideration of the current state of the economy.

The 2-percentage point hike in GST to 9 per cent was originally meant to be rolled out sometime between 2021 and 2025. That will now change, said Mr Heng, and the rate increase will not take effect in 2021 – meaning that GST will remain at 7 per cent next year.

READ: Budget 2020: GST to remain at 7% in 2021; S$6b package when it rises

But just to clarify, the increase is still in the pipeline – Mr Heng said it would still be needed by 2025, and the authorities will “assess carefully” the appropriate time to implement the change.

When this eventually does happen though, there’ll be a S$6 billion package for Singaporeans to help ease the transition.

Under this Assurance Package for GST, every adult Singaporean will get a cash payout of between S$700 and S$1,600 over five years.

5. MORE $$$, ESPECIALLY FOR THOSE WITH KIDS, THE ELDERLY

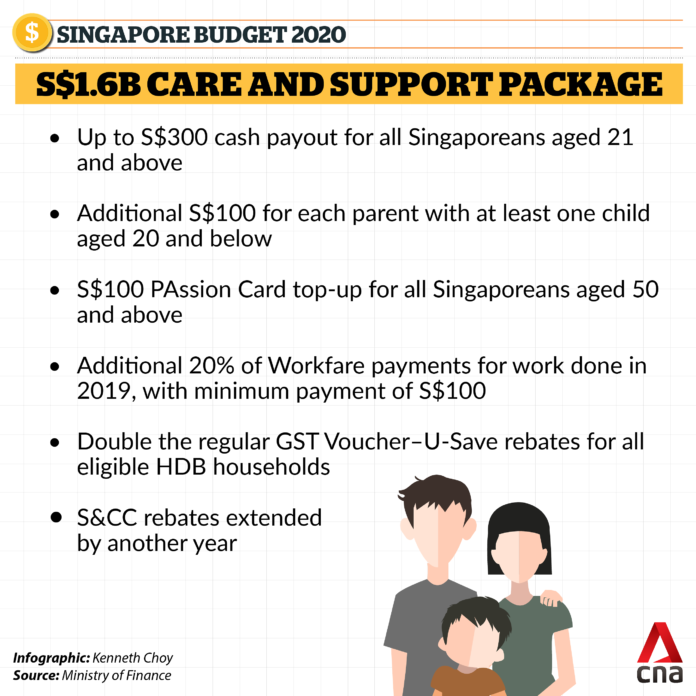

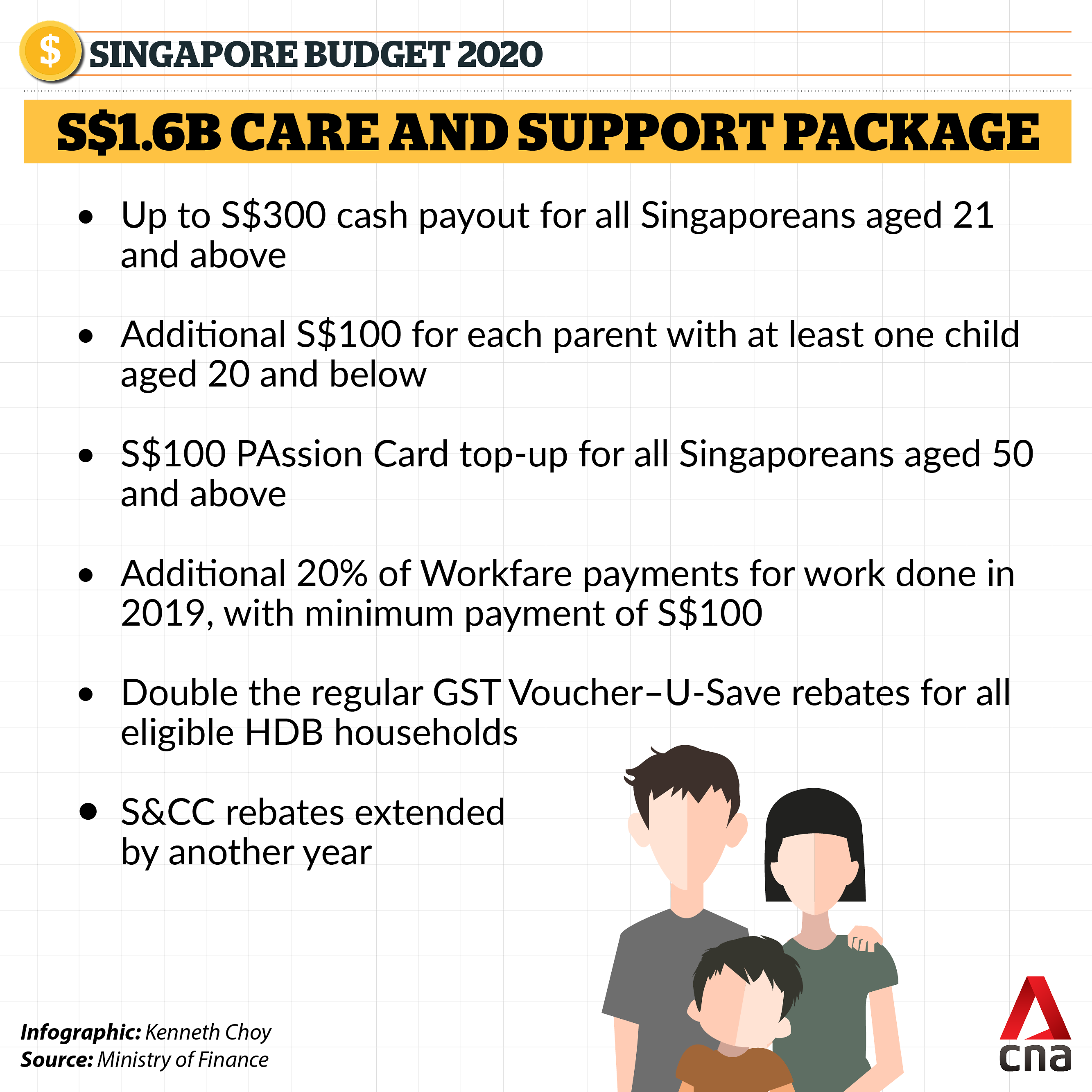

The Finance Minister also fleshed out details of the cost of living package he teased over the weekend. Under the S$1.6 billion Care and Support Package all Singaporeans can expect to get at least some cash to help tide them over.

READ: Budget 2020: S$1.6 billion Care and Support Package to help Singaporeans with household expenses

What this breaks down to:

- For those aged 21 and above: One-off cash payout of S$300, S$200 and S$100, depending on income and/or property ownership

- For those with at least one child aged 20 and below: A further S$100 cash payout

- For those aged 50 and above: S$100 PAssion Card top-up (you can get a card for free if you don’t have one yet)

There’ll also be other support measures, including grocery vouchers worth S$100 a year in 2020 and 2021 for qualifying Singaporeans, as well as enhanced GST Voucher-U-Save rebates.

6. NEW HORIZONS FOR STUDENTS

One of the main themes outlined in this year’s Budget Speech was the importance of personal development. This includes local students, who will be getting additional support to learn from other countries in the region.

The authorities have set a “70-70” target – they want 70 per cent of local Institute of Higher Learning graduates to have overseas exposure, and 70 per cent of the exposure to be in the Association of Southeast Asian Nations (ASEAN), China or India.

READ: Budget 2020: New target for overseas opportunities for students, with focus on SE Asia, China, India

To hit this target, a new Asia-Ready Exposure Programme will be set up to support visits by young people to cities in ASEAN, China and India. Support for internships will also be enhanced under another existing programme.

7. … BUT REMEMBER, IT’S NEVER TOO LATE TO UPGRADE YOURSELF

Of course, learning doesn’t necessarily stop after you’ve left formal education. There’ll be increased support for those who want to develop new skills even as they develop their careers, with additional investment in the SkillsFuture programme.

First off, there’ll be a one-off SkillsFuture Credit top-up of S$500 for every Singaporean aged 25 and above, available from Oct 1 this year.

READ: Budget 2020: More support for transformation of workforce, including SkillsFuture top-ups

It’s a use-it-or-lose-it situation though – unlike the previous S$500 credit which had no expiry date, the new top-up will expire by the end of 2025.

If you’re a mid-career worker – i.e. those in their 40s and 50s – you get extra credit, with an additional S$500 top-up for every Singaporean aged between 40 and 60 (again, it’ll expire in about five years).

The authorities will also introduce additional measures to help these workers, including a salary support hiring incentive for employers to hire local jobseekers aged 40 and above.

8. … EVEN IF YOU’RE A “SENIOR WORKER”

And looking even further ahead, there will also be lots of support for older workers who want to work longer, in the form of a new Senior Worker Support Package.

As part of this, a new Senior Employment Credit will give employers wage offsets when they hire Singaporean workers above the age of 55. This replaces the existing Special Employment Credit and Additional Special Employment Credit schemes which are set to expire at the end of the year.

Other measures include money given to employers to offset CPF contribution rates for workers aged 55 to 70, after contribution rates go up next year.

9. HELP FOR LESS WELL-OFF SENIORS TO SAVE FOR RETIREMENT

Help will be given to support lower- to middle-income Singaporeans between the ages of 55 and 70, who might not be able to meet their retirement needs.

READ: Budget 2020: New scheme to help those with less CPF savings to save more

Those who have not been able to set aside the prevailing Basic Retirement Sum will be able to get extra support under a new retirement savings scheme. This will see the Government matching every dollar of cash top-up made to their CPF Retirement Account, up to an annual cap of S$600.

A small segment of seniors will also get enhanced cash payouts under the current Silver Support Scheme.

10. MAYBE TRADE IN YOUR GAS GUZZLER SOON?

Another big topic in this year’s Budget Speech? Climate change.

Last year saw the introduction of a carbon tax, and in a further bid to go green the Government is now targetting the domestic transport sector – specifically, vehicles with internal combustion engines (basically the ones that run on petrol or diesel).

These vehicles contribute to pollution and adversely affect people’s health and quality of life, said Mr Heng.

READ: Budget 2020: Additional incentives to encourage use of more environmentally friendly vehicles

That’s why the goal is to phase them out, and have all vehicles run on cleaner energy by 2040. There will be a number of measures to make this happen: For example, an early adoption incentive will be introduced to reward those who buy fully electric cars and taxis.

The authorities are also looking to roll out way more charging points, with a target of up to 28,000 chargers at public car parks islandwide by 2030, up from the current 1,600 points.