SINGAPORE: The Straits Times Index (STI) generated a 6.5 per cent decline in total returns in 2018, said Singapore Exchange (SGX) in a report on Thursday (Jan 3).

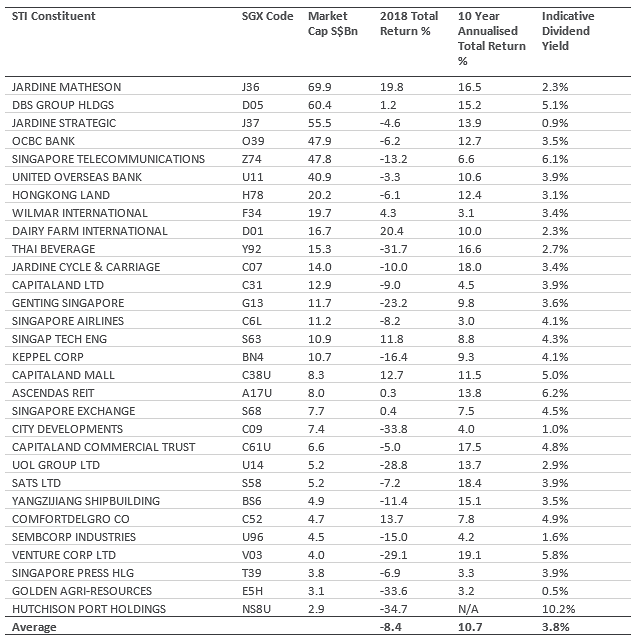

It added that the non-weighted average return of the 30 STI constituents for last year was a decline of 8.4 per cent.

The five strongest stocks in 2018 were Dairy Farm International, Jardine Matheson, ComfortDelGro Corp, CapitaLand Mall and Singapore Tech Engineering, with average total returns of 15.7 per cent, said the local bourse operator.

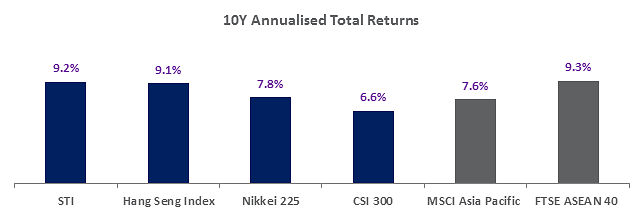

For the 10 years ending 2018, the STI generated annualised total returns of 9.2 per cent, thanks to the reinvestment of dividends.

The figure is one-fifth higher than the regional Asia Pacific benchmark, and in-line with the FTSE ASEAN 40 Index, said SGX.

The STI’s comparative total returns for the 10 years ending 2018. (Table: SGX)

“Without reinvesting dividends the STI’s annualised return over the 10 years would have been 5.7 per cent.

“Dividends have played a key role in these annualised returns, and following the 6.5 per cent decline in total return for the STI in 2018, the 30 constituents currently average an indicative dividend yield of 3.8 per cent,” said SGX.

On a non-annualised basis, the STI’s total return was 140.5 per cent over the period which spanned the end of 2008 to the end of 2018.

Over the 10-year period, the strongest of the current stocks were Venture Corp, SATS, Jardine Cycle and Carriage, CapitaLand Commercial Trust and Thai Beverage PCL.

The STI tracks the performance of top 30 stocks listed on Singapore Exchange. The full list is tabled below:

Table showing full list of STI constituents. (Table: SGX)

The STI fell 0.86 per cent on Thursday to close at 3,012.88.